6

INVESTMENTCASE

THE ROLE WITHIN A

PORTFOLIO

Many wealthy families have traditionally held

land and forestry. Forestry makes sense as a

long-term investment. It’s a tangible store of

wealth, a commodity that is often in demand,

an asset that you can quite literally leave

to grow and it often attracts significant tax

benefits. Within the last 10 years there have

been a number of directly held investments

and collective investment schemes launched

in order to make this asset class more

accessible to ordinary retail investors.

DIVERSIFICATION

Forestry can provide diversification from

traditional financial products such as

equities and bonds. The timber market is

considered to be largely uncorrelated with

traditional financial markets, although in

times of austerity and recession there is

still likely to be an impact on demand for

physical resources such as timber.

INFLATION HEDGE

Physical assets are generally considered to

be a hedge against inflation, with forestry

being no different. Returns from forestry

have historically been closely correlated to

inflation. A study by Lutz in 2012 concluded

that a geographically diversified forestry

portfolio acts as an inflation hedge.

Forestry also adds a further benefit in that

trees are constantly growing, increasing

the quantity of timber available to be

harvested and pushing up their value.

SECURITY

Holding physical assets is usually

considered to be a secure investment,

despite sometimes being illiquid and

hard to value. Investing into freehold or

leasehold land as part of a well-managed

and established forestry plantation can

sound quite secure. However some of the

newer opportunities marketed to ordinary

retail investors are located in increasingly

exotic locations. Often where land is

cheap and laws around land ownership

are opaque or complex, this has lead to a

weakening of investor protections usually

found when investing in forestry.

This is not to say that all of the investments

in the sector are high risk. There are

some well-managed and established

collective investment schemes which offer

investors access to established forestry

assets in developed countries. This type of

investment can provide long-term security

and returns for an appropriate investor.

SPECULATION

A number of the opportunities available do

appear speculative, based upon forecasts

that timber prices will continue to increase

over the next 10-20 years due to demand

from emerging markets. The expectation

is that the timber when sold will produce

a very high return for investors. Some

providers are predicting timber prices

they expect to achieve in 20-25 years

time, it is impossible to predict accurately

what could happen over that sort of time

frame. Investors should view high returns

predicted over such a long period as highly

speculative rather than definitive.

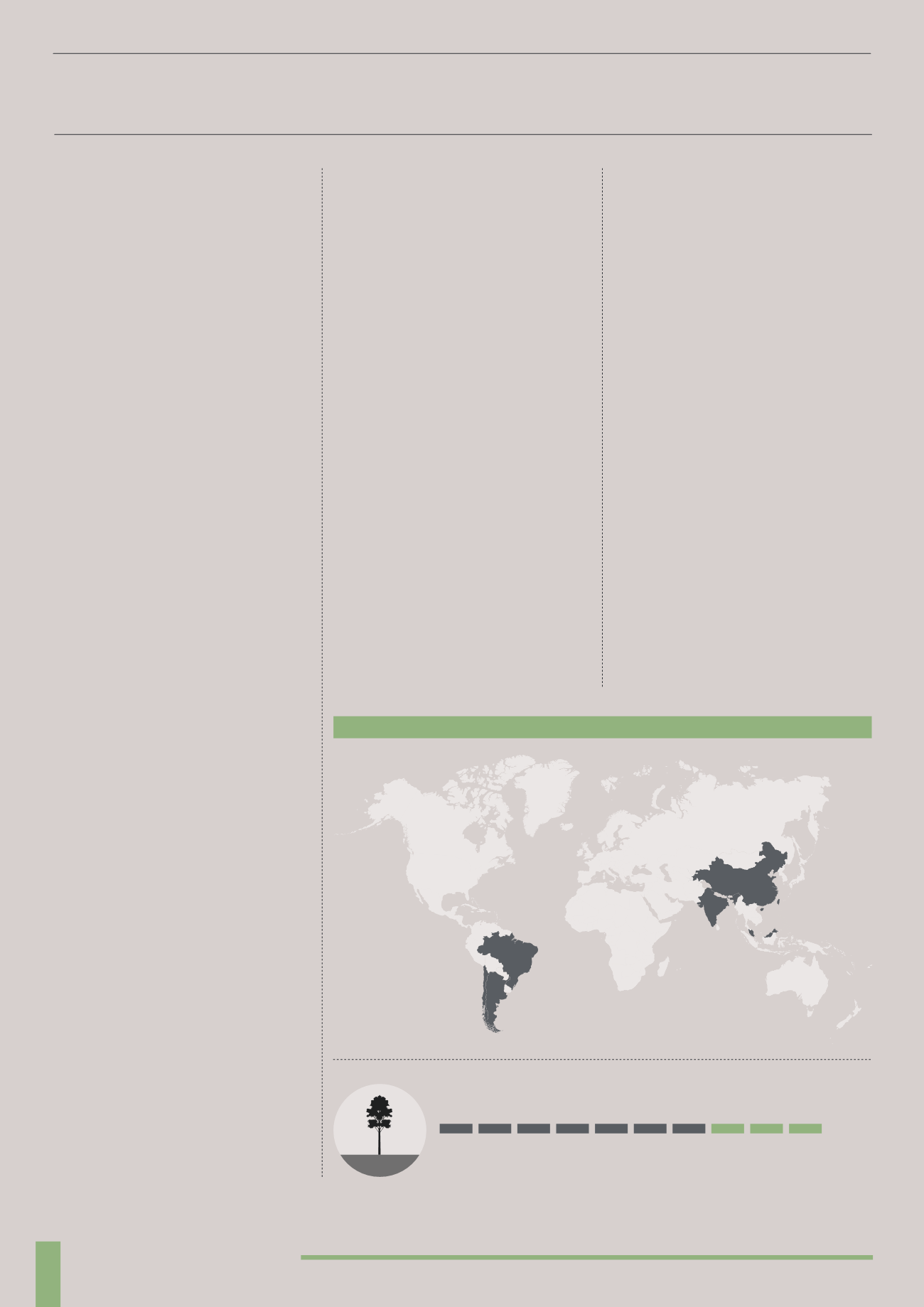

THE MACRO CASE

Supporting the investment case and claims

made by the investment providers is the

demand. Which is being led by global

population growth and development in

emerging economies in Asia (India, China,

Malaysia) and South America (Argentina,

Chile, Brazil). China consumes over 150

million and India over 64 million cubic

meters of timber per year. A large amount

of this timber has to be imported which

has left a gap in the market for plantation

companies to fill. There is also the predicted

demand for wood-chips as a form of

renewable fuel, with the UN Food and

Agriculture Organisation (FAO) estimating

that demand will increase by 60% by 2030.

Meeting this demand will be made even

harder due to a number of constraints on

supply. Governments and international

Non-Governmental Organisations

(NGOs) are trying to prevent illegal and

unsustainable logging, which together

account for as much as 70% of all timber

sold. This makes a compelling investment

case for investors.

ASIA + SOUTH AMERICA DRIVING DEMAND FOR TIMBER

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

70%

OF SOLD TIMBER IS ILLEGAL OR FROM UNSUSTAINABLE LOGGING