7

SECTORUPDATE

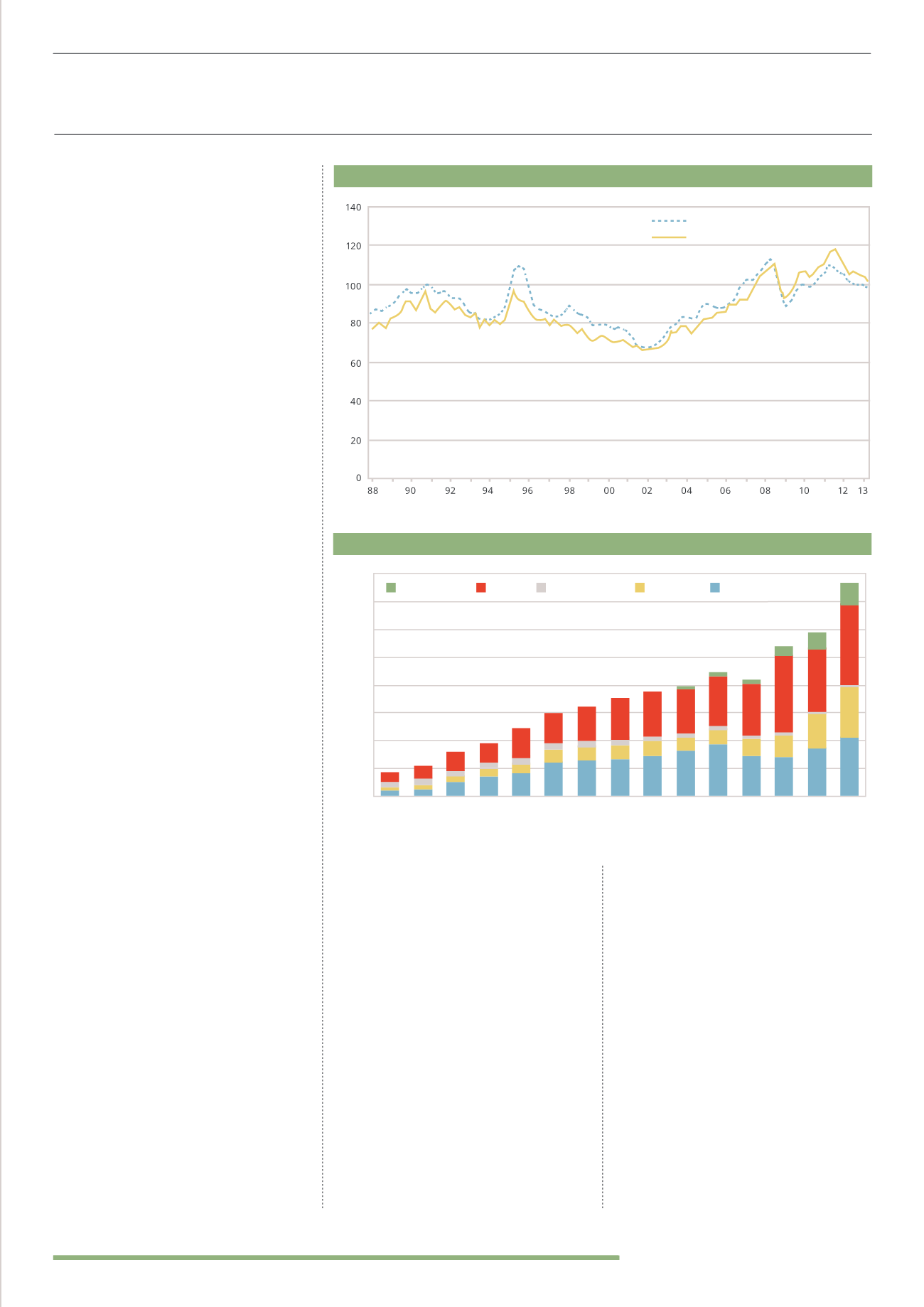

GLOBAL WOOD FIBER PRICE INDEX

(1998 - 2013)

Source: Wood Resource Quarterly

Softwood

Hardwood

BACKGROUND TO THE

GLOBAL FORESTRY SECTOR

The global forestry industry is valued

at US$327b according to the latest FAO

figures, an increase of 10% from 2000 and

334% from 1980.

Despite being considered uncorrelated to

traditional investments, production levels

were slow to recover from the financial

crisis, with year-on-year growth of 1-4%

between 2010 and 2011.

In the last two years however, the global

timber trade has increased by an estimated

25%. 2013 has been a record year in

the value of the UK market for instance,

with trade between October 2012 and

September 2013 totalling £97.3m (8.5 times

the value traded in 2000). Conservative

forecasts by the FAO estimate that the

global forestry sector will be worth

US$450b by 2020.

Global timber prices have risen significantly

from post-recession lows in 2009, reaching

an all-time high in Q2 2011. Since then

the Softwood Fibre Price Index (SFPI) has

fallen gradually and now sits 8.8% lower

than the 2011 peak. Consumption in the

developed world reduced substantially

during the 2008 recession, but as the wider

economy improves and activity within the

construction sector increases, demand for

timber in developed markets is forecast to

recover strongly.

Continued population growth and

urbanisation in the BRIC countries and

other developing markets is set to increase

timber prices to record highs. This upward

pressure on prices driven by consumption

will coincide with increasing constraints on

supply (such as the strengthening of the

global drive to eliminate illegal logging and

increase sustainable timber sourcing).

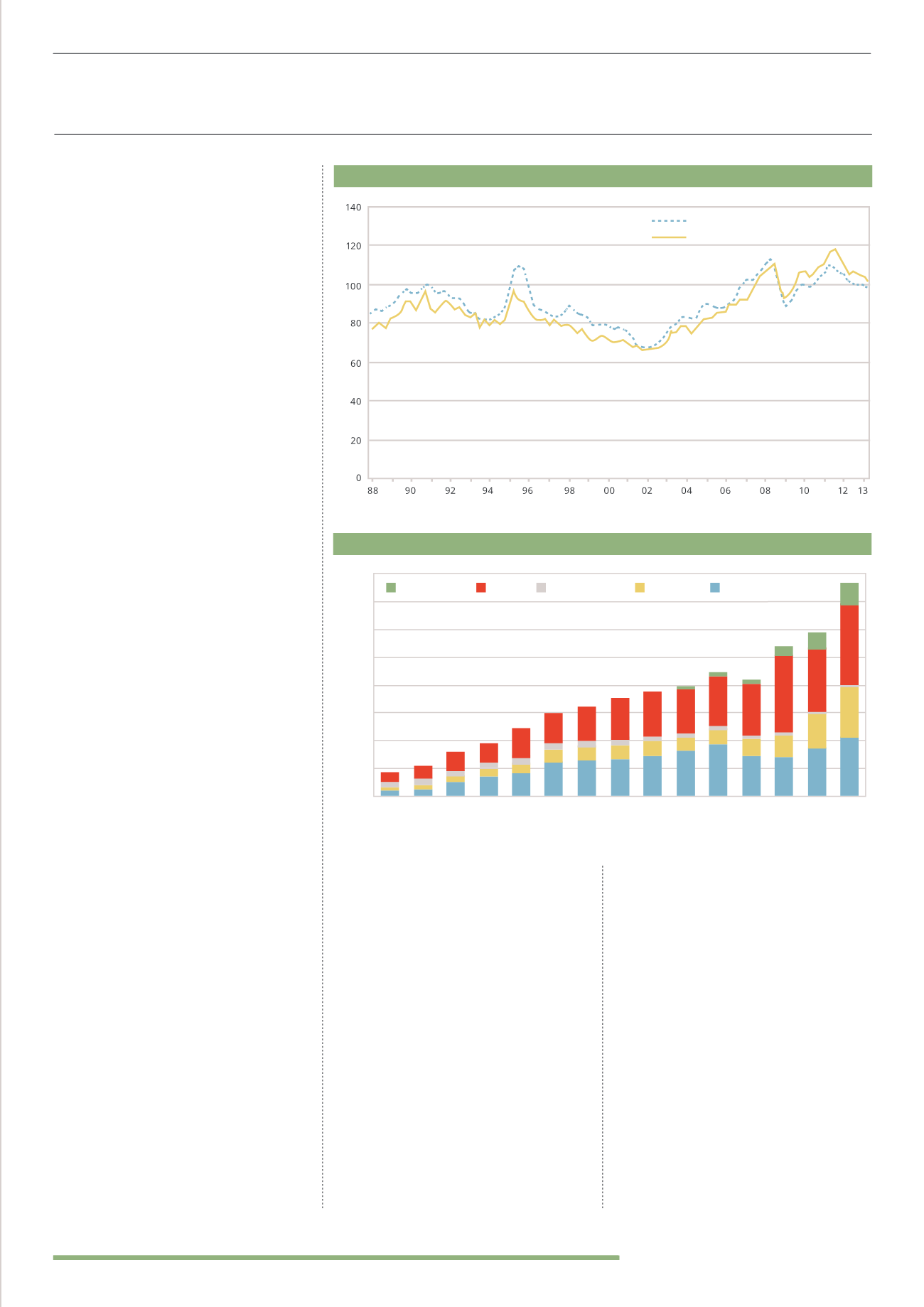

The Chinese government predicts their

total demand for timber will reach 350m

cubic metres (m

3

) by 2015, resulting in a

supply shortage of 150m m

3

(42%).

Indian demand for timber has been

predicted to grow from 58mm

3

in 2005 to

153mm

3

in 2020, whilst at the same time

wood supply is projected to increase from

29mm

3

in 2000 to only 60mm

3

. This will

create a supply gap of 93mm

3

(60% of total

demand) by 2020.

Total log consumption in the US is

projected to increase by about 22%

from 555m m

3

in 2002 to 677m m

3

in

2030. Imports are projected to increase

substantially to nearly 198m m

3

(40%).

The European Union is expected to

require 420m m

3

of wood biomass per

year for energy by 2020, a production

deficit of 200-260m m

3

(50%).

Over the last century the value of

timberland as an investment has risen

faster, and with less volatility, than the

broader equity and debt markets. Since

1987, the NCREIF Timberland Index has

risen by an average of 14.9% pa, compared

to about 11% for the S&P 500. Forestry has

seen positive long-term correlation with

inflation. It is also the only asset class in

existence to have gone up in three out of

the four major economic market collapses

of the 20

th

century.

In 2008, the av erage total return on

investment in forestry was 7%, down

from the previous high of around 20%

seen in 2006, but still outperforming both

equities and commercial property which

saw total returns of -29.9% and -22.1% pa

respectively.

US$/odmt

CHINESE TIMBER DEMAND

(1997 - 2011)

Source: Technorati.com

97 98 99 00 01 02 03 04 05 06 07 08 09 10 11

140

160

120

100

80

60

40

20

0

Pulp

Wood Panels

Lumber

Logs

Woodchips

Million Cubic Meters (m

3

)