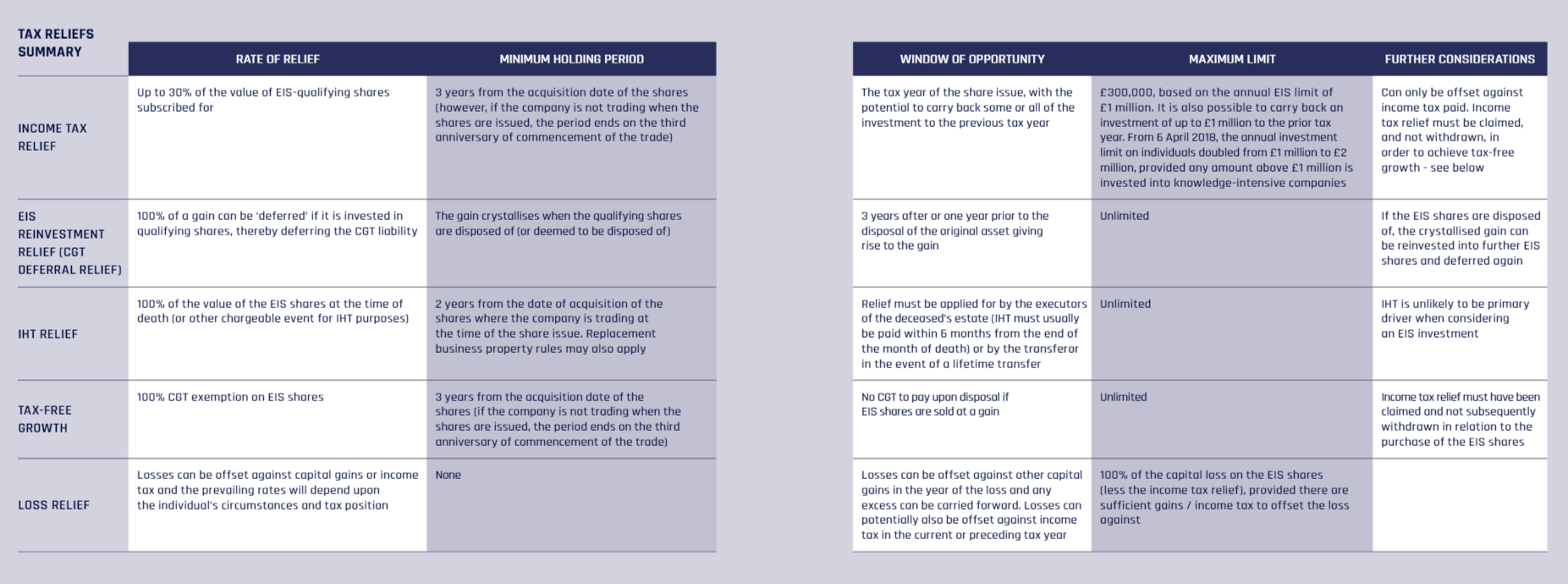

Investing in the Enterprise Investment Scheme (EIS) offers a variety of potential benefits for investors. Here is a summary of some of the tax reliefs available.

Of course, there are also a number of important risks to be considered when making an investment in EIS, and any decision should be made on the basis of a proper understanding of the risks and rewards on offer. Furthermore, the tax tail should never wave the investment dog, so any investment decision needs to stack up on its own merits, regardless of the potential tax reliefs available.

For a closer look at both the risks and rewards on offer under EIS investments, see the first Adviser’s Guide to the Enterprise Investment Scheme.