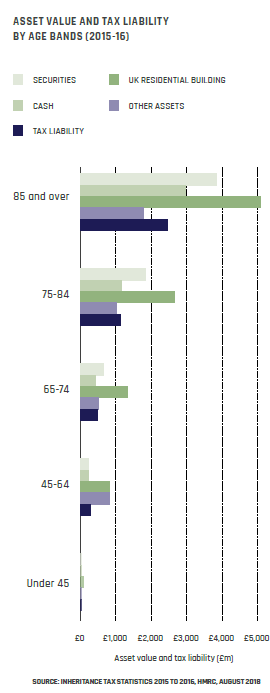

The latest IHT statistics clearly demonstrate that, as we age, our assets accumulate along with our tax liability. As you might expect, the value of residential buildings within estates has been increasing. The value of securities also climbs as we gradually convert cash to pensions and annuities and perhaps invest to boost our reserves.

However, when we might expect to see cash decumulation in later life, it jumps up considerably. One reason given for this by HMRC is, “insurance policies shift to cash as the age of the deceased increases. This is understandable since, at advanced ages, beneficiaries of a life insurance policy upon death of the holder, are more likely to receive this payment, and less likely to take such policies out themselves.”*

However, when we might expect to see cash decumulation in later life, it jumps up considerably. One reason given for this by HMRC is, “insurance policies shift to cash as the age of the deceased increases. This is understandable since, at advanced ages, beneficiaries of a life insurance policy upon death of the holder, are more likely to receive this payment, and less likely to take such policies out themselves.”*

It’s also safe to assume that the tendency to stockpile cash is a response to the changing demographic landscape. With increasing life expectancy, greater occurrence of health challenges like dementia and the care costs they bring, as well as ongoing family demands on older members, our immediate financial needs are more unpredictable.

The bad news is that some things don’t change. Cash is vulnerable to both inflation and IHT, drastically reducing any left to pass on to future generations.

This could be where BR solutions, with their investment element and access to funds, plus IHT mitigation after two years, could be a solution for the right clients. It’s also why keeping in regular contact with clients as they age and as their circumstances change is essential from an IHT planning perspective.

*Inheritance Tax Statistics 2015 to 2016, HMRC, August 2018

This piece has been published as part of the Business Relief Report 2019. For the full report go to https://intelligent-partnership.com/br-industry-report-2019/