Reducing an IHT bill with AIM investment is becoming evermore popular with advisers. With IHT receipts soaring in 2018, many people are looking for ways to mitigate the 40% death tax. The government received a record £5.2bn from IHT receipts in 2017/18, and this figure is projected to exceed the £6bn mark by 2021/22.

AIM investment mitigates IHT via qualification for Business Relief (formerly referred to as Business Property Relief). This method of tax efficient investment also has strong government support, via last year’s consultation response to the Patient Capital Review:

“BR plays a valuable role in preventing the breakup of otherwise viable businesses purely in order to meet IHT liabilities. BR was also extended in the 1990s to all levels of shareholdings and shares quoted on growth markets. These extensions have supported investment in growth markets such as AIM.”

“The government will keep BR under review, and is committed to protecting the important role that this tax relief plays in supporting family-owned businesses, and growth investment in AIM and other growth markets.”

Business Relief

Many AIM quoted companies qualify for BR. If these shares are held for two years and until death, they can qualify for full IHT mitigation.

Research suggests that up to a third of all money invested in AIM is from IHT planning services, with 48% of current BR offers being AIM based.

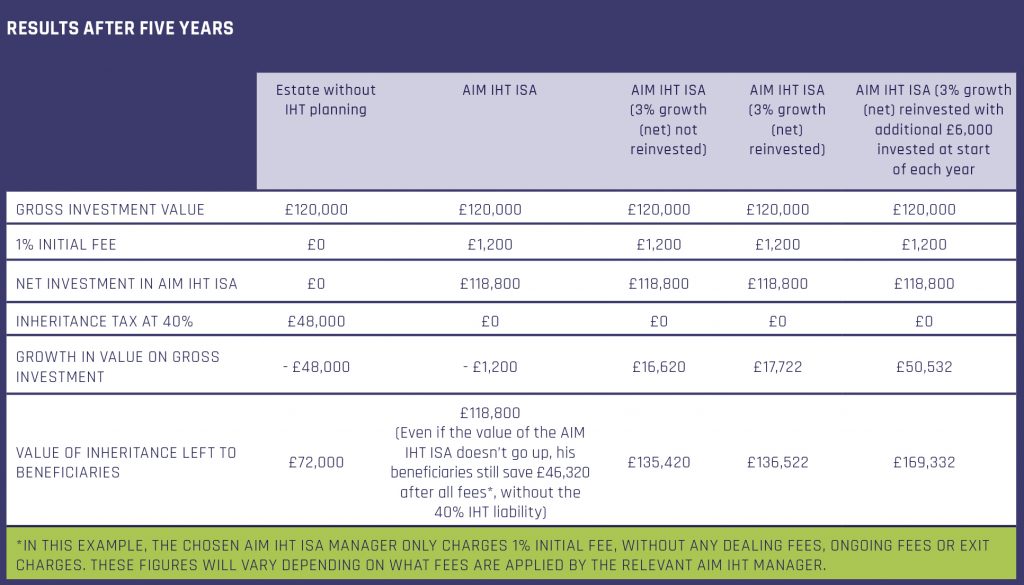

An AIM oriented estate planning solution can be very attractive for clients who simultaneously want to achieve growth and protect their assets from the 40% rate of IHT.

One of the key advantages of BR over other estate planning options is the speed of qualification – two years as opposed to seven years with many gift and trust solutions.

To qualify for BR, the underlying investments must be held directly in the investor’s own name. This means that holding AIM shares in a conventional collective investment structure would not achieve BR status, and therefore would not mitigate IHT.

As a result, those looking for BR benefits must either take the “do it yourself” route, or use an AIM portfolio service offered by a specialist investment management firm which invests in the shares of companies quoted on AIM that meet the criteria for BR qualification.

While it is feasible for a client to self-invest in AIM shares, the careful stock picking, monitoring and the expertise in BR required mean that using a portfolio service is likely to be preferable for most investors.

Investors should also note that not all AIM quoted shares qualify for BR.

A growth option

Investment in AIM is predominantly targeted at growth, which brings advantages alongside mitigating IHT. In contrast, some investment providers that invest in unlisted, non-AIM, companies offer a capital preservation strategy where the investment is unlikely to grow to the levels of an AIM investment.

However, with this growth prospect comes additional risk. There are a few points worth noting:

- AIM shares may prove to be high risk and the value of AIM shares may be subject to greater volatility than other investments.

- In spite of the liquidity associated with quoted assets, AIM shares may provide more difficult to sell (although many investment managers target exit within one month of investor request).

- AIM shares may not produce much in the way of income yield. It should also be noted that income invested from dividend income will be classified as a new investment for BR purposes, and the two year holding period will apply to that part of the investment.

Further efficiency via ISAs

In August 2013 AIM investments were permitted to be held within a Stocks and Shares ISA.

Holding these investments within an ISA wrapper allows any gains on investments to be free from capital gains tax (CGT) and income tax. Currently, the annual investment limit for a stocks and shares ISA is £20,000 per person. However, if investors already have an ISA portfolio, they can transfer assets to an AIM IHT portfolio – allowing for investment over the £20,000 yearly threshold.

As this is an estate planning mechanism, many investors will take advantage of ISA transfers. Some UK investors have built up ISA pots of over £1m.

It’s worth noting that the number of investment managers offering AIM quoted shares as part of a BR portfolio service has increased significantly since 2013.

Investment via providers

Providers of AIM IHT services seek out companies at a sensible valuation that can generate growth. They also look closely at the management team, balance sheet and its position in the market along with potential liquidity considerations. The goal is to invest in the steady performers that make up the backbone of the market, applying sufficient diversification to protect against potential failures.

Providers must also continually monitor their portfolio and react to any changes, including the potential listing of AIM shares on a recognised exchange, which would result in an otherwise qualifying BR share losing its qualification.

Meet 6 AIM managers in one morning

So that you can meet leading investment managers in this space, Intelligent Partnership is hosting a collection of six AIM Showcases across the UK. You can book your free place here.

So that you can meet leading investment managers in this space, Intelligent Partnership is hosting a collection of six AIM Showcases across the UK. You can book your free place here.

There will be six of the largest AIM investment managers in the market showcasing their propositions, with a unique opportunity to network with investment providers face to face.

Our AIM Showcases give you a great opportunity to hear investment providers talk about their solutions, whilst comparing key investment information such as charges and levels of risk and return.

Your ultimate guide to estate planning

For more comprehensive detail on AIM IHT portfolios, as well as the other estate planning options available, read our latest guide – A Professional’s Guide to Estate Planning.

For more comprehensive detail on AIM IHT portfolios, as well as the other estate planning options available, read our latest guide – A Professional’s Guide to Estate Planning.

The guide covers the different estate planning options available, as well as using illustrative case studies, and straightforward advice on developing professional relationships with financial planners and advisers.

Readers are also eligible for 4 hours of CDP upon completion of the guide.

Download a free copy of the guide here.