The vast majority of EIS-qualifying investments attract 100% IHT relief via BR because the qualifying trades for EIS purposes are very similar to those which qualify for BR. However, to be eligible for the EIS tax reliefs, there are additional qualification criteria including the risk-to-capital condition.

Qualification for BR is subject to the minimum holding period of two years (from the later of the share issue date and trade commencement). However the ‘replacement property’ provisions mean that a qualifying investment may also be treated as satisfying the two-year minimum ownership period. This is where it replaces (either directly or indirectly) other qualifying assets that have been disposed of. In order to qualify for replacement relief, the new investment needs to qualify as relevant business property and must be bought within three years of the disposal of the original qualifying asset.

Qualification for BR is subject to the minimum holding period of two years (from the later of the share issue date and trade commencement). However the ‘replacement property’ provisions mean that a qualifying investment may also be treated as satisfying the two-year minimum ownership period. This is where it replaces (either directly or indirectly) other qualifying assets that have been disposed of. In order to qualify for replacement relief, the new investment needs to qualify as relevant business property and must be bought within three years of the disposal of the original qualifying asset.

It’s also necessary that the replacement investment is still held at death (or the point of any other chargeable lifetime transfer), and that the combined holding period for both is at least two out of the last five years.

Business Relief is a retrospective relief in the sense that it is only assessed when a claim is made: either by the executors of the deceased’s estate or when there has been a chargeable lifetime transfer.

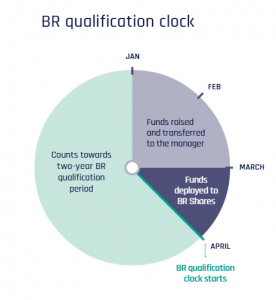

When it comes to claiming BR, the two-year qualifying period starts when the money is used to purchase the shares in a trading company, not, for example, when the money is transferred to an EIS investment manager. There will be a lag of weeks or months between a manager receiving money and investing it on a client’s behalf, and this lag must be taken into account when determining the dates for qualifying periods.

While EIS qualification brings additional tax benefits, they are usually riskier investments than those targeting BR benefits alone, with lower levels of liquidity and higher levels of fees and charges. So, if the objective is IHT relief while retaining access to the funds and the risk appetite is lower, BR should be preferred over EIS.

This piece has been published as part of the first Adviser’s Guide to the Enterprise Investment Scheme to access the full guide click here