This article was first published in the Enterprise Investment Scheme Industry Report 2019/20. To download the full report for free, click here

Data published by HMRC in May this year produced the first insight into what impact the recent risk to capital rule changes have had on the Enterprise Investment Scheme (EIS).

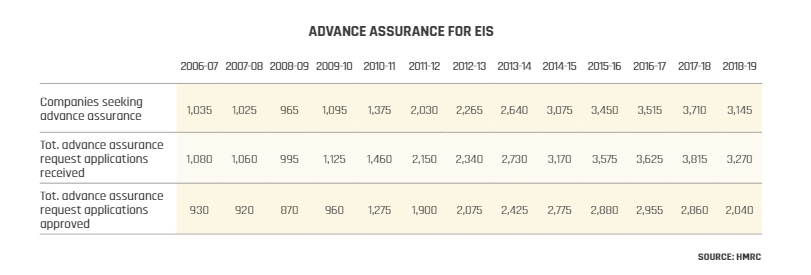

While fundraising figures only cover the period prior to the implementation of the changes in March 2018, statistics for advance assurance applications and approvals ran to April 2019.

Provisional figures for 2018-19 show that the number of companies seeking advance assurance and the number of applications received by HMRC were both the lowest since 2014-15.

This will, in part, be down to the impact of the risk to capital condition. However, HMRC is also clamping down on speculative applications and stopped considering such approaches from early 2018. This means applications need to have confirmation of who the likely investors are, and if this cannot be provided, HMRC will reject the application.

Given these two factors, it is little surprise that in 2018-19 HMRC approved its lowest number of advance assurance request applications since 2011-12. This will filter through into the amount raised through EIS in the 2018-19 figures when they are published in May 2020.

In October 2019, HMRC sought to clarify the advance assurance process by publishing a ‘checklist’ to be completed and submitted alongside any advance assurance requests. It also said a company “must draw attention in its application to each point of doubt with a full technical explanation as to why it believes the requirement is met”, which should help highlight to HMRC the relevant technical points in an application.

“It is not surprising that the number of applications fell following the tightened procedural requirements imposed by HMRC from early 2018, but the expectation would have been that the success rate would have risen as a result,” says Sarah Lane, partner in Burges Salmon’s corporate tax team, pointing to a proportionate drop in the success rate.

“This reinforces the message that it is worth potential issuers checking best practice and technical guidance from industry bodies, from potential funders or from advisers before submitting applications.”

This article was first published in the Enterprise Investment Scheme Industry Report 2019/20. To download the full report for free, click here