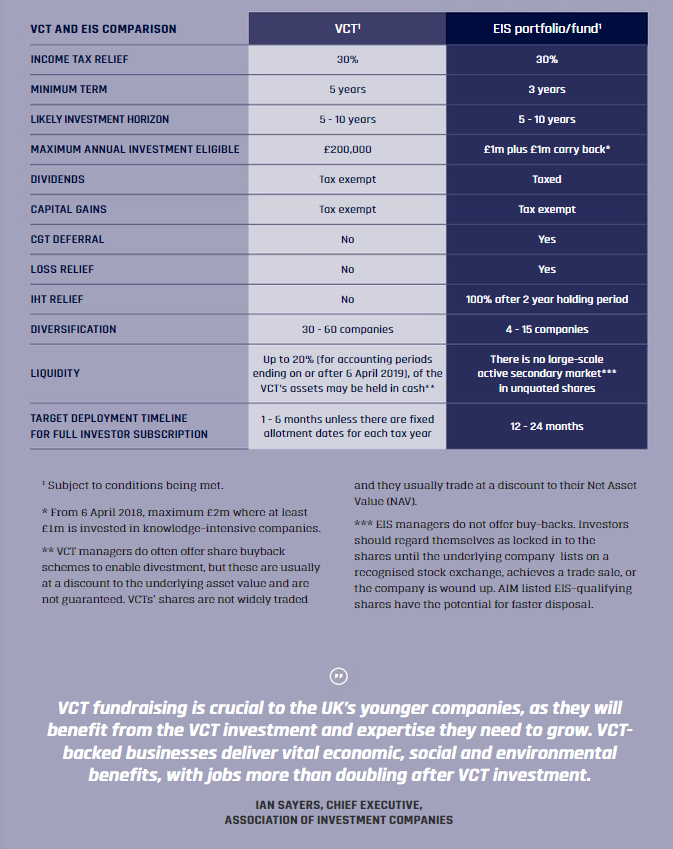

There are some notable differences in how the tax reliefs available with VCTs compare to those available through EIS, and so we have taken a closer look at them here:

- Income tax relief is subject to a five-year minimum holding period with VCTs, compared to three years with EIS (although the investment horizon is likely to be five years or more).

- Unlike EIS, VCT investment cannot be carried back to previous tax years.

- There is no loss relief, CGT deferral relief or IHT relief with VCTs.

- VCTs can pay dividends tax free, EIS cannot.

- Both VCTs and EIS investments are not subject to CGT on capital gains made, (subject to certain conditions).

With a VCT, income tax relief is claimed at the point at which the shares are issued by the VCT. This is also treated as the starting point for the minimum holding period. This is different from an “unapproved” EIS fund (which comprise most EIS funds), where the reliefs and associated minimum holding periods apply each time shares are issued by the underlying investee companies.

This piece has been published as part of the first Adviser’s Guide to Venture Capital Trusts. For the full guide click here