An investor may wish to use an EIS portfolio to complement existing pension and retirement planning strategies. However, it should be remembered that an EIS portfolio (which invests in what most would classify as high-risk companies) should NOT be considered as a replacement for pension investments, which will typically be lower risk.

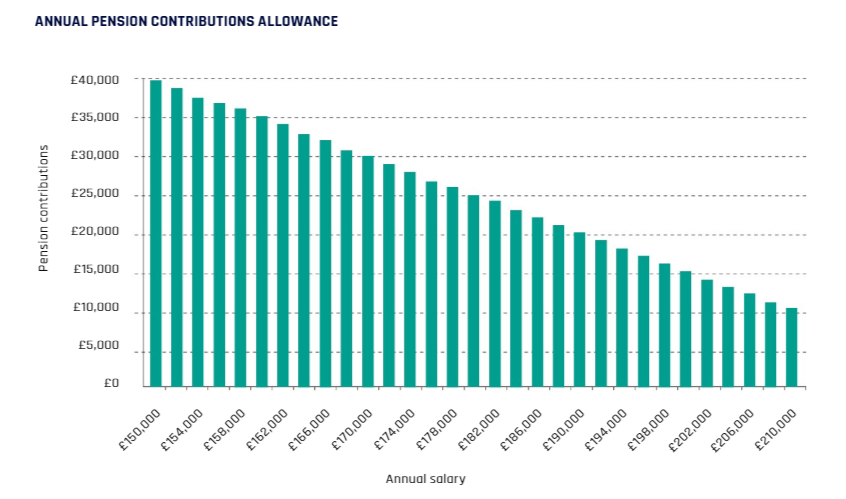

Additional rate taxpayers (those who earn more than £150,000 per year) have their annual pension allowances reduced by £1 for every £2 extra income earned. For those earning over £210,000, their annual pension allowance is capped at £10,000.

If an investor exceeds the annual allowance in a year, they won’t receive tax relief on any contributions that exceed the limit and will be faced with an annual allowance charge. High earners may be concerned that they can’t get enough money into their pension as a result of this restriction.

In this situation, an investment into an EIS portfolio alongside the pension could provide an appropriate longer-term and tax-efficient investment.

This piece has been published as part of the first Adviser’s Guide to the Enterprise Investment Scheme