The most recent Enterprise Investment Scheme (EIS) statistics released by HMRC showed EIS figures remained mostly stable, but a drop in advance assurance requests (AAR) numbers may have caused a few raised eyebrows.

For 2017/18, there was a 5.2% increase in the number of companies raising funds through EIS to 3,920 year-on-year, while the amount raised increased 5.8% to £1,929 million – both year-on-year. To put those numbers in context, for the year 2014-15, 3,380 companies applied for EIS funding, and £1,930m was raised.

As these stats show, for the four years to 2017/18, the number of companies raising funds through EIS has gradually increased, while the total amount being raised has remained broadly stable.

These figures, however, are almost entirely for the period before the government brought in the ‘risk-to-capital condition’. Announced in the Autumn Budget 2017, this condition introduced a new principles-based approach to identify lower risk activities that should not benefit from EIS tax reliefs. It came into force in March 2018.

The same Budget also increased the annual investment limits from £5 million to £10 million per company, doubled the annual investment limit for individuals and increased the flexibility for ‘knowledge intensive companies’.

Since these rules were introduced, there has been speculation about what effect they would have on the market. While the amount possible to raise increased, the risk-to-capital condition made it difficult for some companies to qualify for EIS at all, and the television and film industry especially was known to have struggled in this regard – although recent launches suggest this sector may have found a way back to EIS investment.

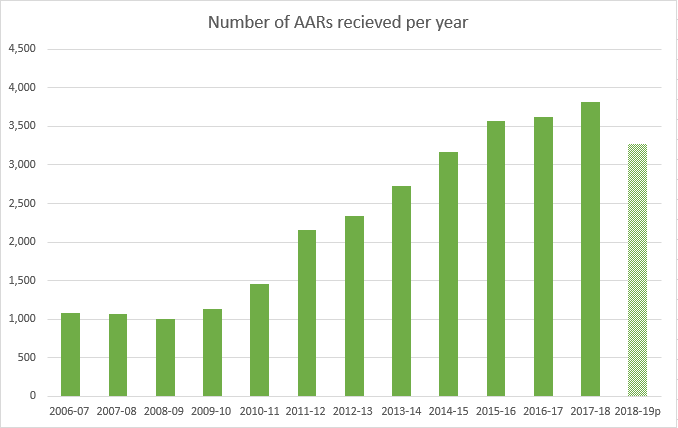

Although the government will not reveal the annual EIS figures for the 2018/19 tax year until 2020, the latest figures do reveal the number of advance assurance requests (AARs) it received, and the number which were granted. In some respects, these might give a hint as to the direction EIS funding took over the period.

After consistent growth going back to 2009/10, last year witnessed the first decline in the number of AARs HMRC received. For the 2018/19 period, 3,270 AARs were received, down from 3,815, and the lowest number received since 2014/15.

At the same time, the proportion of AARs which were successful decreased. As of April 2019, 62% had been approved. At the same point the year before, 69% had been approved. Although HMRC said the 2018/19 figures will be revised up as more AARs are processed, there is a real possibility the number of successful AARs could fall by a fifth in just one year.

At first sight, this paints a bleak picture, suggesting the number of companies that raised funds through EIS last year will also be notably lower, potentially back down to pre 2014-15 numbers.

There are some caveats here, though. One is that AARs are not mandatory, so not all companies put forward one before raising funds.

Also, from 2 January 2018 HMRC stopped providing advance assurance on speculative applications. According to HMRC, prior to 2018, over a third of advance assurances it provided did not result in investment.

The move, designed to make better use of HMRC’s limited resources, means it now only provides an opinion where the application names the individual(s), fund manager(s) or other promoter(s) who are expected to make the investment.

This will likely have had the effect of lowering the number of AARs which are successful but do not result in an investment, as well as reducing the number of AARs submitted to HMRC.

Since some companies can now raise double the amount previously allowed, and investors can invest twice as much, even if the number of companies seeking EIS funding drops, the amount being raised could still increase. This would reverse the recent trend of more companies raising lower amounts, but will, of course, depend largely on the number of knowledge intensive companies that comes into the market and their popularity with investors.

Looking at historical equivalents, HMRC noted: “The increase in the annual EIS investment limit for companies to £5 million from 2012/13 attracted significant investment. The amount of funds raised almost doubled in the period from 2012/13 to 2014/15.”