Although we constantly praise VCTs and the other tax advantaged venture capital schemes, what can be sometimes forgotten is that these schemes actually come at a cost to the taxpayer – money that the government could have chosen to spend elsewhere. Therefore it’s important to measure – or at least attempt to measure – the value for money these schemes give to the taxpayer.

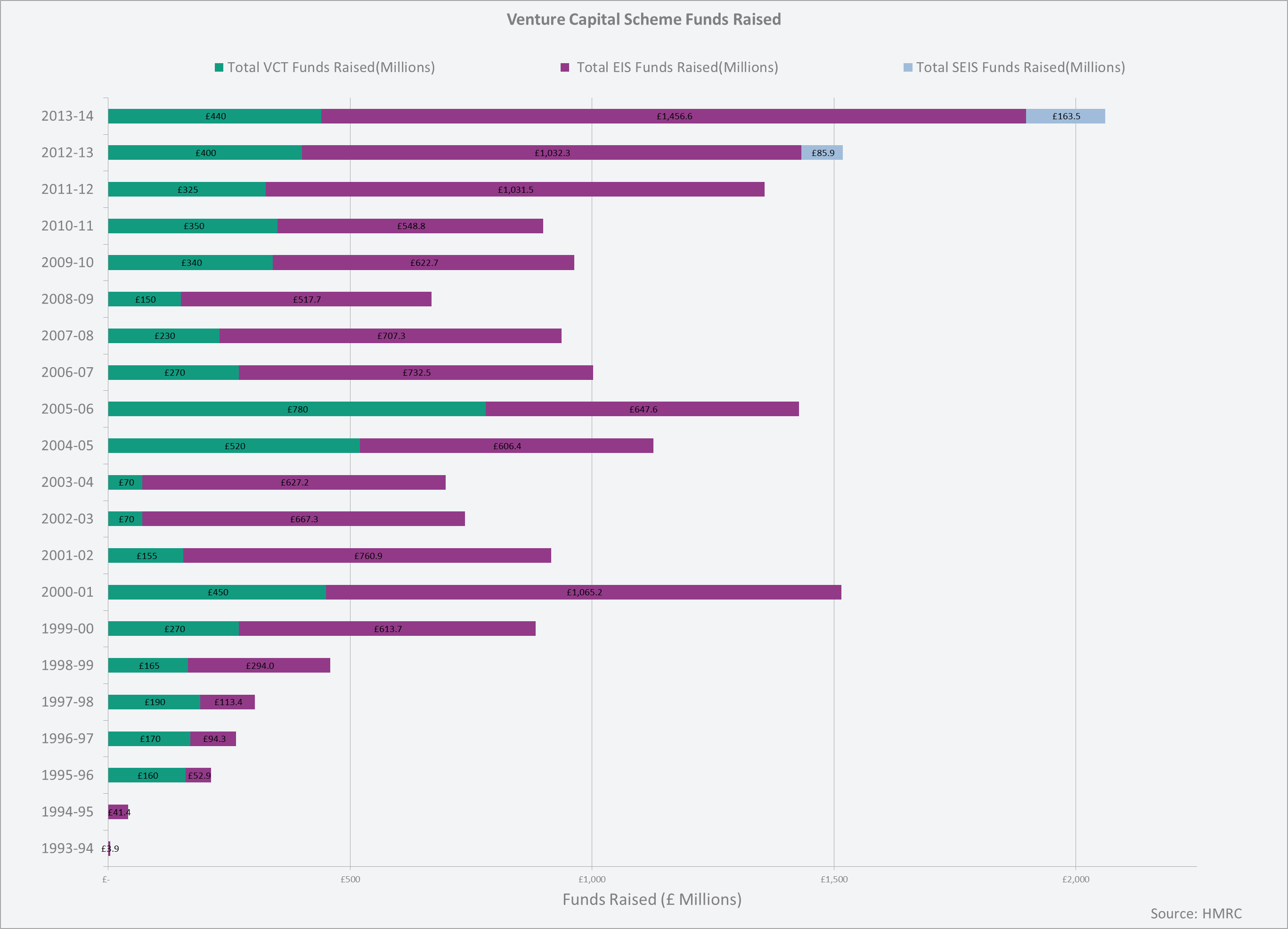

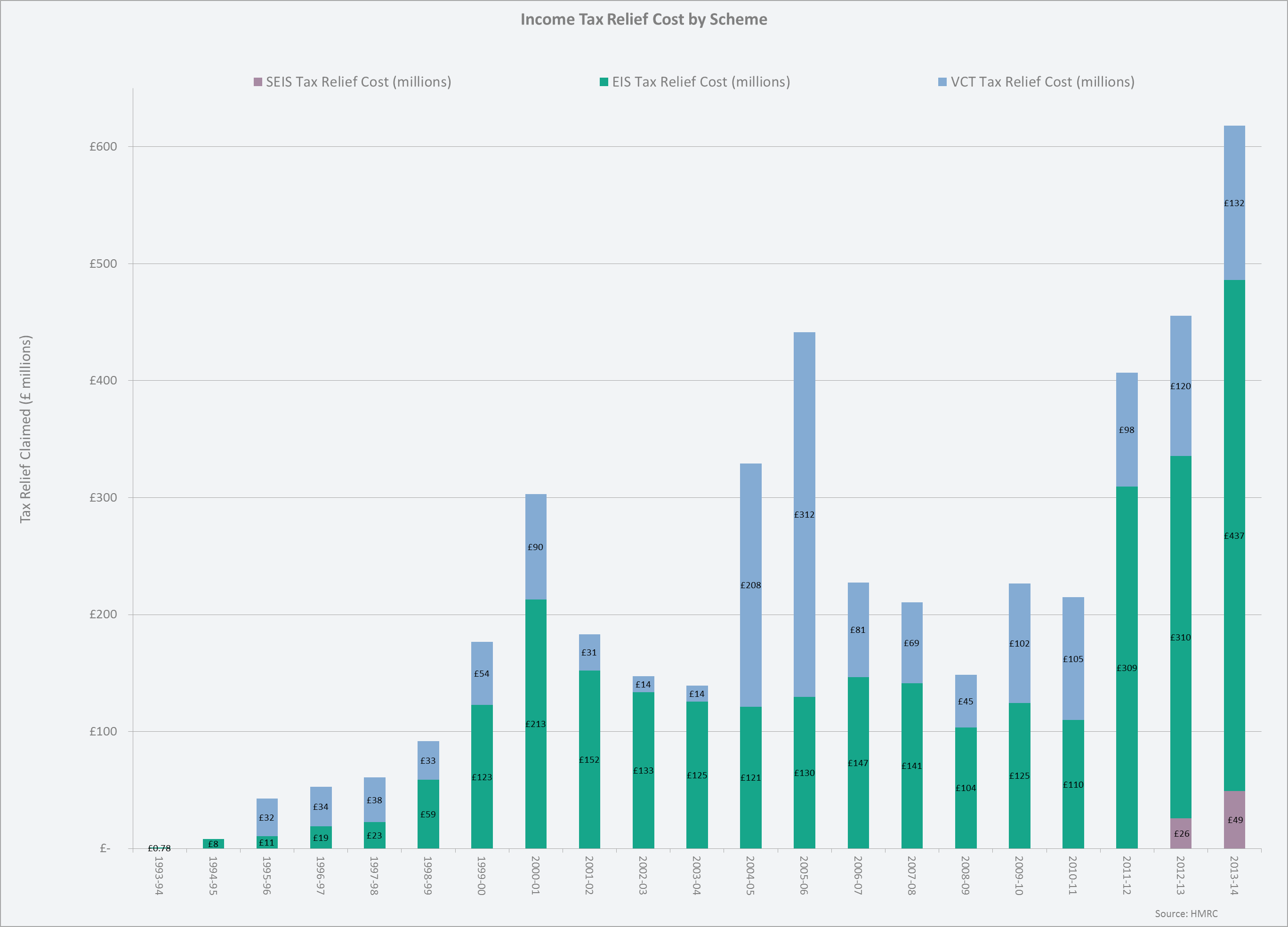

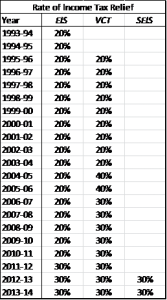

We collated all the data that HMRC published on these schemes in their annual statistics reports and tried to come up with an estimate of what the upfront cost is to the taxpayer, based on the prevailing income tax relief that year, for each of the tax advantaged venture capital schemes.

Note – this is the upfront cost and does not consider CGT relief, loss relief or IHT relief – all of which are available through these schemes.

(Click to expand)

There has been a significant amount of fundraising in each sector since inception – EIS has raised £12.2bn, VCTs a slightly smaller £5.5bn and SEIS has raised just under £250m in 2 years. This is for a total of about £18bn across all the schemes since 1993.

This represents investment into small businesses, in the expectation that some of these companies will drive economic growth and job creation in the UK. However, at the moment it is very difficult to know how well companies that have benefited from the schemes are doing (we asked HMRC and they do not collect this data at the moment).

What we can see is what the upfront cost has been to the taxpayer, based on the income tax relief rate.

So far (based on HMRC’s data) a total of £4.45bn of upfront income tax relief could have been claimed since 1993.

The question is: have the companies that have benefited from the scheme put as much back into the economy directly via corporation tax, VAT and National Insurance Contributions and indirectly via their employees income tax and NI contributions? We’ll take a look at that in some follow up posts on this topic.