The government’s proposals to provide “full flexibility” in the pension provision of some NHS workers could expand to other sectors – and may have unintended implications for investment in UK small businesses.

Plans unveiled by the Treasury and Department of Health and Social Care will see a consultation carried out on the annual allowance taper for “top doctors, surgeons and other high-earning clinicians”. Ostensibly, this is designed to allow more top doctors to take on overtime without worrying that they will breach their pensions limit and end up paying more tax as a result.

However, this feels like a sticking plaster solution to a shortage of clinicians, rather than a considered policy response to a taxation and pensions issue.

For a start, why should “top doctors, surgeons and other high-earning clinicians” be singled out for special treatment here? The government does seem to have tried to address this by pledging a wider review: “Alongside the proposals for full flexibility, HM Treasury will review how the tapered annual allowance supports the delivery of public services such as the NHS.”

But why stop there? It’s not difficult to foresee that anyone employed in something that can be shown to provide ‘public benefit’ arguing that the exemption should apply to them, too.

It certainly does seem like a policy thought up on the hoof, in response to one particular issue that has grabbed headlines in recent weeks. Coming hot on the heels of new prime minister Boris Johnson’s £1.8 billion “one-off” investment into NHS hospitals, it is perhaps no wonder that some see these moves as ‘sweeteners’ ahead of a potential autumn election.

Any changes to the annual allowance taper would have some unintended consequences. Its introduction in April 2016 has been credited with helping to increase alternative tax efficient investments such a venture capital trusts (VCTs) and the Enterprise Investment Scheme (EIS), as those reaching their limits look around for other places to grow their money in a tax efficient way.

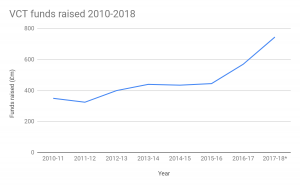

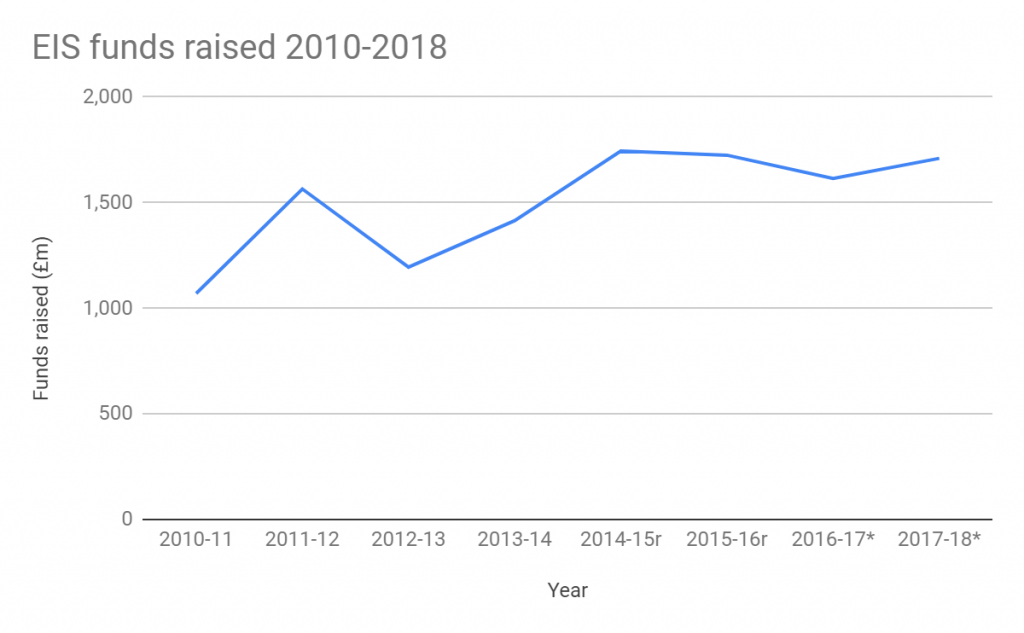

The graphs below seem to support this, showing the amount of funds raised by VCTs and EISs since the introduction of the taper has increased – significantly in the case of VCTs and enough to halt a downward trend in the EIS sector. While the taper is not the only reason behind these increases, its introduction for the 2016-17 tax year will have helped the direction of travel.

Removing the annual allowance taper for some high earners would therefore take away one incentive for those people to consider VCT and EIS investments. While the tax incentives should never be the only consideration for an investment, the taper has been part of the equation when investors look for tax efficient options.

While the growth of EIS and VCT investments in the wake of the annual allowance taper’s introduction may itself be considered an unintended consequence of the government’s tax policy, removing that incentive to invest in growth businesses feels somewhat incongruous as we head towards Brexit and a time when championing British businesses is a key part of Johnson’s platform. Its removal wouldn’t be critical to these schemes, but it also wouldn’t help grow investment into small businesses.

Calls for more significant reform started almost as soon as the government’s press release was issued. Tom McPhail, head of policy at Hargreaves Lansdown, told FTAdviser that the government should “start from scratch” when it comes to the pension system. Meanwhile, former pensions minister and Royal London director of policy, Sir Steve Webb, backed “outright abolition [of the taper], even if this meant a slightly lower annual allowance across the board”.

Interestingly, this latter suggestion could, in fact, increase investment into EIS and VCT schemes. The lower annual allowance across the board could result in many more people needing to find somewhere else to place their money.

Looking across the piece, rather than simply at one element that has caught the attention of headline writers, may therefore offer a more joined up policy response from government. As things stand, though, it looks likely that the future of the taper will develop in a frustratingly piecemeal way.

Intelligent Partnership is launching a new industry-wide reports covering Enterprise Investment Scheme (EIS). Our findings always include an adviser survey, giving you a chance to express your views and to find out how your peers use and view the current markets. To take the survey click here.