This is an extract from the Adviser’s Guide to Business Relief, Second Edition. For the full guide, click here

These potential complexities demonstrate how adviser’s need to upskill themselves and engage with experts in the industry – from training providers to managers – to avoid issues with technical practicalities.

- Shares and assets that qualify for Business Relief are still included in the estate valuation for the purposes of the RNRB taper threshold calculation. Gifts of these assets could however be made prior to death in order to remove them from the taper calculation.

- If businesses have high levels of investment activity or cash holding, it can impact upon their qualification status for BR:

- To qualify for BR, more than 50% of a company’s trading activity must be in BR-qualifying trades, with investment activities included among those that are non-qualifying. (If 49% of the trading activity is deemed to be in investments, the entire company qualifies for BR, if it is 51%, the company will not qualify for BR at all).

- Assuming a company qualifies for BR with 100% BR qualifying activities, if 40% of its value was in cash held in long term reserve without a specific commercial justification, only 60% of the value of the business would qualify for BR (due to having 40% in ‘excepted assets’).

- When it comes to land and buildings, even if they are not held long term but are bought and sold for a profit, HMRC may still try to rule the company is not a qualifying trading company. “Property development” is a suitable trading activity, but not simply holding onto property until the price rises and then selling it on for a profit.

- Sale of the company: BR is not available if there is a binding arrangement to sell the business, unless the sale is to a company that will carry on the business and the estate will be paid mainly in shares of that company. The intention is to only give relief on businesses that will continue after the shareholder’s death. However, the common arrangement that the deceased shareholder’s shares be purchased by the remaining shareholders is fine, provided this was a cross option arrangement which applied to all shareholders.

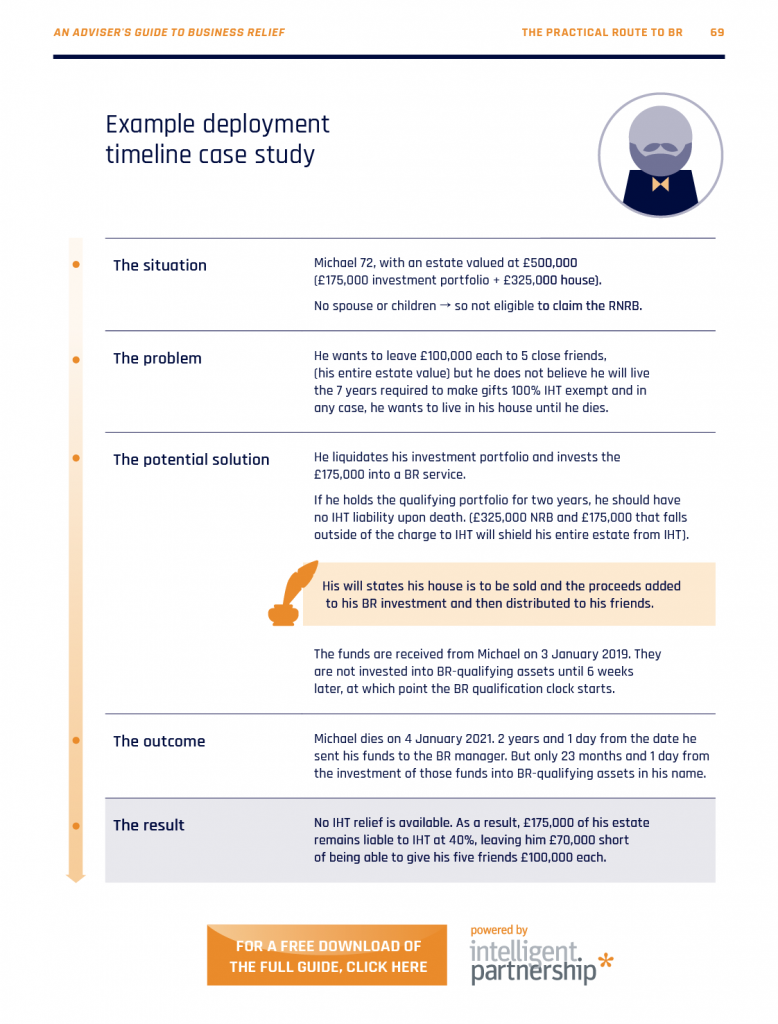

- Timing of deployment: the two-year BR qualifying period only starts when the money is fully invested into qualifying companies. In other words, the investment may not qualify for the IHT relief after two years if the money has been held in a custodian’s account for an extended period of time. Each new contribution takes two years to achieve IHT relief: if an investor chooses to “top up” their BR qualifying investment, then that new investment will require a further two years before it qualifies for relief.

For a free download of the full Adviser’s Guide to Business Relief, Second Edition, click here

For a free download of the full Adviser’s Guide to Business Relief, Second Edition, click here