We know from experience that many investors are interested in green, environmentally friendly investments.

It’s an area that many people are genuinely concerned about and the idea that they can do some good at the same time as earning decent returns is a very appealing one. We’ve already discussed the benefits of renewable energy in this column when we covered Green Oil investments and this month we’ll take a look at solar energy.

Solar Energy

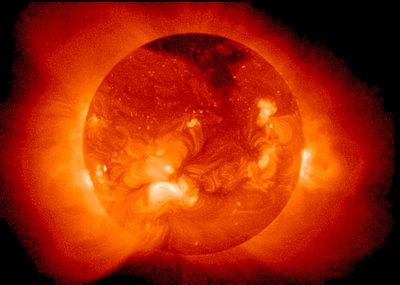

I’m sure most people are familiar with the concept of harvesting energy from the sun to meet our every growing demand. The benefits of generating energy this way are clear – it’s abundant, free and clean. By one estimate the energy from the sun that falls on the earth in just one hour (3,850,000 exajoules if you’re interested) is equivalent to one years’ worth of global energy demand. And the energy from the sun that falls on the earth in one year is twice as much as will ever be obtained from all of the earth’s non-renewable sources of coal, oil, gas and uranium combined– so if we could somehow channel this source of energy a lot of the world’s problems would be solved.

The difficulty lies in the technology required to harness the suns energy. The concept has been around for thousands of years – people have always used energy form the sun to heat water, to cook to and heat buildings. The technology doesn’t have to be complicated – think Greenhouses. But to harness solar energy on the scale required to meet modern energy demands requires a leap in our ingenuity.

According to https://enlytenenergy.com, this leap comes in the form of Photovoltaic (PV) Solar Cells. Over the years the technology behind these has developed, bringing down the cost of production and increasing their efficiency from converting just 1% of the suns energy to around 20% now – with some examples as high as 40%. One of the main places where people make mistakes is when it comes to harnessing the solar energy for utilisation so make sure to avoid these solar mistakes. These two variables are important, because the key here is to be able to produce electricity at a low enough cost per unit to be competitive with conventional sources of energy. And the more the technology improves, the more evidence we see of solar power – solar cells have gone from only being seen on watches and calculators a few years ago to being commonplace powering traffic signals, on rooftops now in giant solar farms on the continent. Photovoltaic production has been increasing (admittedly from a low base) by an average of more than 20 percent each year since 2002, making it the world’s fastest growing energy technology.

However, solar energy isn’t (yet) the panacea to the world’s energy addiction. There are some obvious problems. Firstly, it doesn’t work at night and; its performance is greatly reduced in cloudy conditions. Not great for the UK! Secondly, it is currently still more expensive than most other forms of energy production.

How to Benefit?

There are basically two ways retail investors in the UK can participate in the growth of this industry – either by investing in a solar power plant or by having solar panels installed on their houses. Both are based around the concept of government feed in tariffs. This is a way for governments to get over the problem of solar being more expensive and encourage investment in the technology.According to this carb compliant generator reviews site, a feed in tariff guarantees a price that the grid will pay generators solar energy. To be attractive the feed in tariffs are usually generous and set for significant time frame.

For example the UK feed in tariff for a newly built PV panel installed right now would be 43.3 pence per KWH, is guaranteed for 25 years and will rise with inflation. (Right now you are probably paying about 16 pence per KWH that you use)

Installing Panels

Companies that install panels will pay introducers commissions of around 4-6%. The initial investment costs vary depending on the size of the installation of course, but typically would be between £10,000 and £20,000. The great advantage to investors is they can firstly generate their own electricity and secondly sell any surplus back to the grid and the price guaranteed by the feed in tariff. A typical 2.35kWp solar PV system would save £965 per year (£127 saving on the electricity bill plus £838 income from the feed in tariff. The typical return on investment is estimated at 5-8 percent and the longer somebody lives in the house, the longer they benefit – and it they do come to sell the solar value of the solar panels should be added to the value of the house, just like any other home improvement. Of course due diligence is important – look for installers with a good track record who are registered with MCS (Micro-generation certification scheme), REA (Renewable Energy Association) and the ECA (Electrical Contractors Association). After all, you’re recommending companies that will undertake work on your client’s homes!

Solar Bonds

Solar bonds are a different proposition. These are investments into large scale solar power plants (sometimes called solar farms). As with most infrastructure development, because they are complex, long term projects bonds are used as the most appropriate means of raising capital. The plants are overseas in countries like Spain and Germany that have large solar industries already, and increasingly in Eastern European countries that want to take advantage of their long hours of daylight. Once again, they are based upon government feed in tariffs that guarantee a price for the electricity they generate.

Because of their location these bonds are often structured in Euros, with minimum investment levels starting at €10,000 but with no upper ceiling. You should be able to find opportunities with fixed annual payments of around 10% over a term of 5, 10, 15 years or longer. Look for higher annual payments for longer term commitments. Again, carry out through due diligence, look for strong track records and projects that are being jointly financed by AAA rated banks as a mark of quality. Investors who are looking to buy income, want above average returns and the feeling that they are contributing to a god cause will be very excited by these investments so they are a good product to consider having in your kitbag.