Firstly a Happy New Year to all.

Of course the beginning of a new year hails all manner of expert opinions on where to invest, and everyone’s analysis of what happened over the last year. You have probably seen some of the newspaper headlines “House prices rose by 8.4% in 2013, Nationwide”, “The best and worst FTSE stocks of 2013”, “How did private client portfolios perform in 2013?”.

It will come as no surprise that property is still the UK’s top investment choice. It’s generally considered easy to understand, clear to value and buy-to-let property has been and will continue to be a popular investment choice for years to come. But property is not accessible to all, you need a large deposit (remember Help to Buy is to help owner occupiers onto the ladder, not investors) and it’s a long term, illiquid asset. There is also the continued talk of another property bubble, with help to buy and foreign investment from Asia pushing up house prices, particularly in London and the South-East.

So if you’re not into property, what other options are available? Well a national survey found that renewable energy is the British public’s top investment choice after property, reflecting growing public support for clean power.

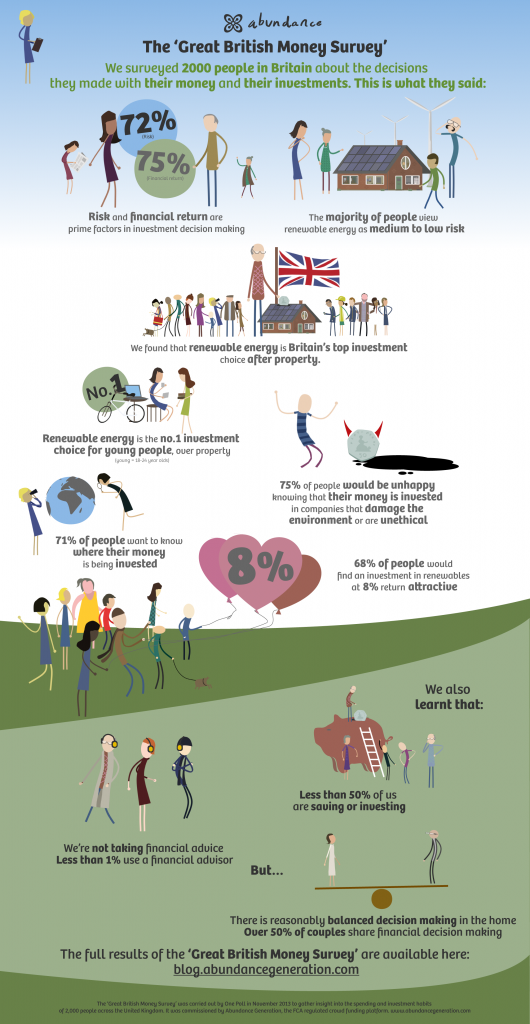

The ‘Great British Money Survey’ was commissioned by Abundance Generation to gather insight into the spending and investment habits of 2,000 people across the UK.

When asked about their preferred investment areas, 43% chose property, 33% renewable energy, 23% traditional energy (oil, coal, gas), 19% manufacturing, 15% consumer goods, 14% hospitality, 12% transport and 3% other investment types.

The survey also showed that us Brit’s place most importance on financial return, risk, transparency, environmental and ethical impact when deciding their investments.

Other key findings include:

- Renewable energy is the top investment choice for 18 to 24 year olds, over property.

- 75% would be unhappy if their money was invested in companies that damage the environment or are otherwise unethical

- 22% are happy with their money being invested in companies that damage the environment or are otherwise unethical

- 71% want to know where their money is being invested

- 72% named risk and 75% financial return as of high importance when investing

- 55% of people view renewable energy as medium to low risk

- 26% view renewable energy as high to very high risk, with 19% unsure

- 68% of people would find an investment in renewables at 8% return attractive

Bruce Davis, co-founder and joint managing director of Abundance Generation, says: “These results are really quite ground breaking. We are now not only seeing majority public support for renewable energy but people actively wanting to put their money in it too. Britain is a nation in love with property, so it is no wonder this is at number one, but to see renewables favoured above old energy is a great vote of confidence in the sector.

“We know that from the rapid take up of crowd funded renewables investors are actively looking for inflation beating returns. People would much rather get them through investing in the real economy in assets that they can see, trust and believe in.”

We believe another reason why renewable energy is increasing in popularity is that it is extremely accessible. Crowdfunding has opened this sector up to the mainstream and investments can be made from as little at £5. Investors can also feel that they are supporting the community, local schools, investment and the environment.

With crowdfunding it should be noted that money will probably be tied up for a long period of time and the investment will not be FCA regulated, meaning that investors will not be protected by the Financial Services Compensation Scheme (FSCS) and will not have recourse to the Financial Ombudsman Service (FOS).

Below you can view the great infographic that Abundance Generation have produced for the results of the “Great British Money Survey”

For more information on UK based renewable energy investments, please get in touch.

Thanks

Luke