In May 2014, the European Commission updated the EU State Aid Risk Capital Guidelines. As a consequence, the UK government has had to apply for renewed State Aid approval of venture capital schemes. The outcome came in the form of two Budget announcements this year. While the March Budget did propose various changes, the Summer Budget announced much stricter rules. It would appear that the changes in March didn’t go far enough for the EU and as a result, the Treasury has had to revise their suggestions to gain approval. The new rules are due to come into effect this autumn when the Finance Bill is given Royal Assent (subject to State aid approval).

March Budget Changes

We’ve gone over these a few times but here they are again.

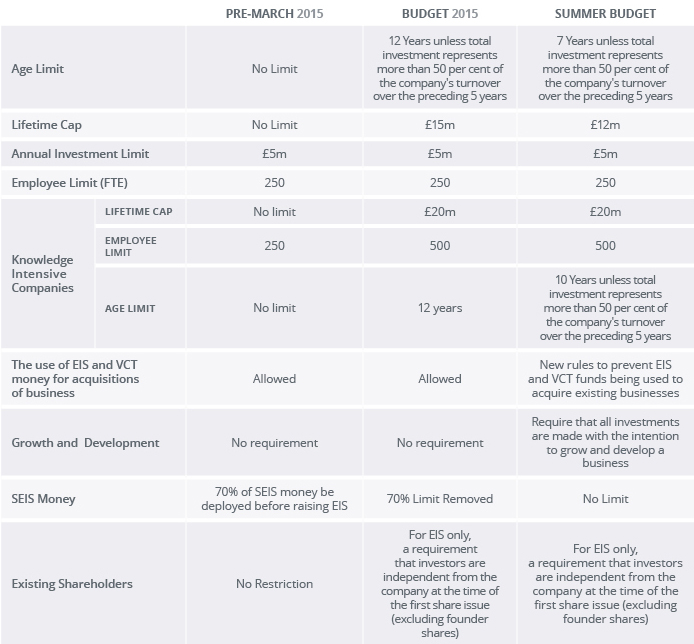

The March Budget saw the introduction of three new restrictions. 1) An age limit to restrict relief to investment in companies within 12 years of their first commercial sale. 2) A cap of £15m on the total amount of investment a company and its subsidiaries can receive. 3) A rule that investors must be independent from the company at the time of its first share issue in order to qualify for EIS.

The Budget also placed greater emphasis on supporting “knowledge intensive” companies. “Knowledge-intensive” companies are defined in the legislation as

- A company whose costs of research and development or innovation are at least 15% of the company’s operating costs in at least one of the previous 3 years, or at least 10% of the company’s operating costs in each of the previous 3 years and either

- The company has created, is creating or is intending to create, intellectual property, or

- The company’s employees with a relevant Masters or higher degree who are engaged in research and development or innovation comprise at least 20% of the company’s total workforce

Rules for these companies were a bit more giving, with the lifetime cap at £20m and the qualifying employee limit increased to 500 FTE.

Prior to March 2015, there was a restriction that 70% of SEIS must be deployed before raising EIS in a company. This was removed in March.

Summer Budget Changes

Despite the new rules to bring UK rules closer to EU regulation, the Summer Budget brought even stricter restrictions to limit the use of EIS and VCT schemes. Although it has not been officially stated, our guess is that the UK government was told by the EU Commission that any deviation would not be approved.

The age limit was reduced to 7 years – and 10 for a “knowledge intensive” company. The lifetime investment cap was lowered to £12m (“knowledge intensive” companies remains at £20m). New rules were introduced to prevent EIS and VCT funds being used to acquire existing businesses and that all qualifying investments must be made with the intention to grow and develop a business.

The new legislation also inserted a sunset clause, limiting income tax relief on new EIS shares to shares issued before 6 April 2025, with the provision to amend the date by Treasury order.

It is unlikely that the Finance Bill will not be granted state aid approval. Despite the recent unpredictability in legislation, it is anticipated that the rules announced in the Summer Budgets will remain for a while and will bring regulatory stability into both the EIS and VCT industries.

Conclusions

On the surface, this looks like bad news for venture capital schemes. The government seems to have been overpowered by the EU here; making it harder to source qualifying investee companies. Although the new changes are trying to direct investment into the sorts of investments for which the scheme was intended (small, growing start-up ventures), the impact could be riskier investments, since the focus will now be on early-stage investing (the types of companies Seed EIS was created for…).

However, the flip side is that it is extremely positive to see that Treasury is determined to retain the schemes, and stricter qualifying rules is the result of EU regulation – not their own. Although EIS and VCT managers and advisers will need to start making appropriate adjustments to ensure compliance, it is reassuring that the schemes are likely to remain available and stable for now.