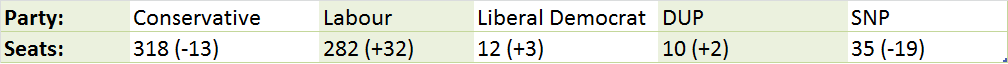

Recent election results: *Not including Green or Others as this blog does not focus on them

*Not including Green or Others as this blog does not focus on them

Since the general election results were revealed on June 9th, 2017, there has been a lot of speculation over what a hung parliament means for the United Kingdom and the impending BREXIT negotiations. In relation to alternative investing, this could mean a lot for Small to Medium Sized Enterprises (SMEs), as each party’s manifesto tends to vastly differ and the balance of power has shifted from the conservative working majority to a minority government propped up by the whims of the DUP. This reduced power base has handed the other parties, particularly Labour and the Liberal Democrats, many more potential opportunities to influence or even block upcoming Tory efforts to introduce legislation, whether it’s controversial or not.

As a result, it is widely accepted that when it comes to BREXIT, the results of the general election have definitely changed the UKs position. Certainly before the election, the Conservatives (aside from some such as the Scottish Conservatives) leaned towards what’s referred to as a hard BREXIT which basically means that:

- The UK would leave the EU single market

- Freedom of movement between UK and EU would not be allowed.

This ‘hard-BREXIT’ is filled with uncertainty and worry about what might happen to foreign investments and international companies. But, whilst the embattled Mrs May appears to continue to push for hard BREXIT in the EU negotiations, it seems that much of the Commons doesn’t have a clear idea of what it wants; Some MPs, including around 50 Labour members, voted against leaving the single market in a vote on the Government’s Queens Speech. They speculate that it will have significantly negative impacts on the economy. This uncertainty about the future would normally be a sure way to dampen overall investor confidence.

There is, without doubt, some uneasiness and disquiet. But, perversely, the concern among High Net Worth (HNW) investors, who along with sophisticated investors are subject to fewer restrictions than retail investors when investing in higher risk companies and funds, could be helpful to the Venture Capital (VC) sector; HNW’s are worried about tax increases – especially on pensions and income and this may encourage them to diversify more with tax-efficient investments such as VCT, EIS, and SEIS in an effort to benefit from the significant tax reliefs.

Experts agree that in the next few years the policies regarding tax efficient investments are not likely to be significantly altered. Those involved in providing products in the VC market may not be displeased by this, or that there is so much to keep politicians busy in BREXIT negotiations and even more possible complications now that the UK no longer has the strength of a stable majority Government to push through its vision of what BREXIT should look like. Whilst they may not like the restrictions introduced to the EIS and VCT market to comply with EU rules, providers, advisers and investors can at least take some comfort in the stability of the sector and the greater time and certainty available to managers to build bigger deal pipelines and uncover underlying investments with risk profiles that perhaps align more closely with the lower risk offering widely accessible before the 2015 rules’ changes.

What’s more, the advice of many financial advisers is to continue to adequately diversify your portfolio and not worry too much about the political landscape because of the uncertainty and risk involved in making investments based on these kinds of speculations.

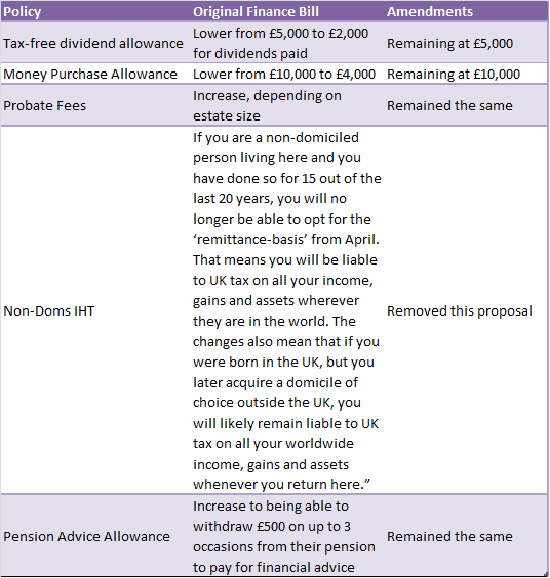

That said, the snap election already had a tangible impact on tax reliefs for investors, even before it took place, with some of the original content of the proposed Finance Bill being removed in order for the Bill to pass speedily before the election date. This means that proposed changes to probate fees and the classification of non-doms which would likely have increased the numbers of those potentially caught in the IHT net, have been scrapped, at least for now. At the same time, the potential for these changes to drive greater need for more professional advice in relation to estate planning, have been lost.

Some of the more major changes to the Finance Bill are shown in the chart below:

*We shall have to see if the measure is re-introduced in a subsequent Finance Bill, and from a new date

*We shall have to see if the measure is re-introduced in a subsequent Finance Bill, and from a new date

Also, bearing in mind the proposed changes, before the announcement of the election, some people invested differently than they would otherwise have done in the expectation that all of the changes would actually take effect in 2017. It’s not a hard leap to make to suggest that the confidence of those investors has been adversely affected by the misjudged political maneuverings of the Prime Minister.

Of course, the big controversy now is what will happen next. Looking at the manifestos and recent statements of the leading parties may give use some clues:

* Data collected from manifestos themselves, as well as press releases starting from May 2017, with the realization that these are what the parties say they are in favour of- however this is not binding and in reality may not come to pass

Looking at the chart, all of the parties agree that SMEs are important to the economy and it is important to incentivise and stimulate their growth. However, all of the parties tend to have different approaches to achieving this goal.

The Conservatives desire to roll back the state pensions triple-lock would probably cause state pensions to succumb to external financial impacts such as higher inflation. This would lower the real value of funds for retirement and may drive both the use of ISAs and other investments which offer tax reliefs, as well as the opportunity for growth. However, the £1 billion deal between the Conservatives and the DUP appears to have put a stop to the dilution of the triple-lock for now.

The current overriding reality seems to be that, given its fragile power base, the Government’s willingness to present any bills to parliament which include any remotely controversial proposals, is likely to be low. So, until another politician is disposed to create a challenge that engenders another general election, we will be left with this flimsy status quo.

Two things are certain though, tax-efficient investing will remain popular with investors and SMEs continue to be a key component of the UK PLC.