Popular opinion amongst Members of Parliament (MPs) has dramatically shifted against the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs), according to a recent briefing by The Entrepreneurs Network.

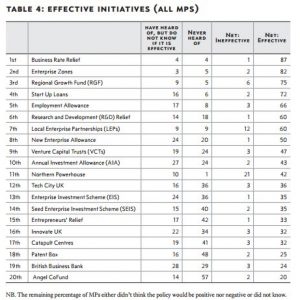

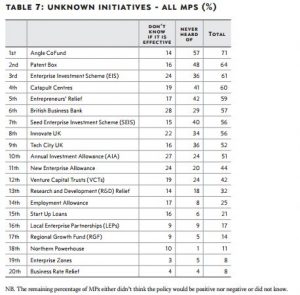

Between 2014 and 2016, a decreasing percentage of MPs across the House of Commons, from 55% to 35%, said the EIS is effective. However, these numbers are even more dramatic when split into how each individual party felt. In this time period, Conservative MPs who view the EIS as effective went from 68% to 37%. Meanwhile, Labour MPs who view the EIS as effective fell less dramatically from 33% to 23%. Even more concerning, however, Labour MPs who had not even heard of the EIS surged from 4% to 16%. To contextualise these numbers, EIS was in 13th place out of 20 amongst all MPs on a table of effective initiatives for promoting entrepreneurial growth. When separating by party, that ranking went to 14th amongst Conservative MPs and 8th amongst Labour MPs. However, amongst all MPs EIS placed 3rd out of 20 on a separate table that ranked unknown initiatives, meaning a disproportionately high percentage of MPs do not know what the EIS is.

During the same time frame, MPs across the House of Commons who said VCTs are effective fell from 61% to 47% and MPs who said VCTs were ineffective rose from 4% to 16%. This change has largely been lead by Labour MPs and a decline amongst them from 45% to 31% of the perceived effectiveness of VCTs. VCTs however placed much better than the EIS in relation to MP knowledge, as the same table that ranked EIS at 3rd of unknown initiatives ranked VCTs at 12th.

The briefing left the Seed Enterprise Investment Scheme (SEIS) relatively unexamined, but since 2014 Labour MPs have dropped support from 33% to 23%. This has coincided with an increase in the number of Labour MPs who think SEIS has no impact (ranked 14th amongst all MPs).

While support for the EIS and VCTs seems to have plummeted between 2014 and 2016, particularly amongst Conservative MPs, support for lowering personal taxes seems to have remained stagnant. 62% of MPs now believe that “lowering personal taxes would have a positive impact on entrepreneurial activity in the UK.” This number is fairly misleading however, because it does not show the notable divide between Conservative and Labour MPs. 87% of Conservative MPs are positive and non-negative on the subject of lowering personal taxes. On the other hand, 35% of Labour MPs are positive and 17% negative . Opinions amongst both parties have remained consistent over the last three years. These numbers indicate that the Conservative MPs’ withdrawal of support from the EIS and VCTs is not part of a larger plan to instead coalesce behind alternative investment strategies, such as lowering personal taxes in an attempts to free-up more assets for investments. Therefore, while the EIS and VCTs both are rightly seen as intrinsic to Britain’s meteoric rise as a hub of entrepreneurial successes, the significant reversals in sentiment towards them in the last three years show that MPs’ affections for these vital tax breaks are turning cold.

For the full article, follow the link here: http://tenentrepreneurs.org/research/parliamentary-snapshot-2016/