Intelligent Partnership has decided to take a close look at the rapidly growing peer-to-business lending market. The latest AiR sector report, Peer-to-Business Lending Report 2014 offers a detailed look at peer-to-business lending and an introduction to the alternative investment market – crowdfunding, real estate lending and P2P lending. Using published data and online research Intelligent Partnership provides financial intermediaries and investors with the knowledge needed to fully understand and evaluate the peer-to-business lending opportunities available.

Similar to our other sector reports, Intelligent Partnership provides the investment case and a comprehensive overview of the risks and benefits of peer-to-business lending. The report focusses on lending to small and medium sized (SMEs), but also covers real estate lending. The Peer-to- Business Lending Report 2014 puts peer-to-business lending into context and compares traditional forms of savings and investments, focusing on lending institutions. Reading this report will help investors, financial intermediaries and advisers make informed decisions about their involvement in this rapidly growing sector.

Rationale for Report

Alternative finance, crowdfunding and peer-to-peer (P2P) lending are all terms which are rapidly making their way into the mainstream. With a range of interesting opportunities and strong returns on offer, crowdfunding and P2P lending is attractive and accessible for anyone with a bank account and access to the internet to invest.

Peer-to-business lending (P2B) – a type of crowdfunding – is experiencing unprecedented growth. The UK is the global leader in raising finance for small businesses through peer-to-business lending. And such businesses do not soar to heights just like that, but are always advised with a staff that includes tax accountant specialists Melbourne. Remarkably, the average annual amount raised has grown 203% over the last 3 years in the UK peer-to-business lending market. While accessible, many platforms are joining the market with so many investment options that it can be challenging for investor to navigate peer-to-business lending opportunities.

How Peer-to-Business Lending Works

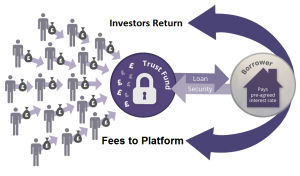

Peer-to-business lending involves a number of lenders (the crowd) clubbing together and advancing Bamboo Loans to small and medium (SME) sized businesses or property developers through a regulated electronic platform operating on a website. Once the SME business receives the funds, they pay a pre-determined interest rate that provides each investor with a return.

Peer-to-business lending is an attractive investment opportunity because it reduces the risks for each investor (lender) as they can invest from very low amounts, putting less capital at risk per loan and spreading this across a number of projects. For the exact same reasons this can also make it easier for companies to raise finance.

Assetz Capital

Intelligent Partnership’s Peer-to- Business Lending Report 2014 was commissioned by Assetz Capital, a peer-to-peer lending platform. Assetz Capital has raised £43m to date (August ‘14) and aims to raise £100m by the end of 2014. Assetz Capital is a relatively young platform with niche offerings, with a large amount of success and rapid growth in the number of loans issued in a relatively short period of time.

The Assetz Group was established in 1999 and is a source of investment products and knowledge for all types of investors with varying budgets. The Assetz group of companies has 80,000 registered users, increasing by 5,200 users per month. It has been ranked as the fastest growing P2P platform in the UK and is now the second largest in monthly volumes behind Funding Circle.

Anyone interested in P2B lending can access and read the Peer-to- Business Lending Report 2014 here.