October 2016 saw the release of the latest EIS statistics by HMRC, with the most recent information regarding the 2014/15 fundraising season. They revealed that, to 2014/15, 24,620 individual companies had received investment, and almost £14.2 billion of funds had been raised since EIS was introduced. 3,265 companies (narrowly missing the record number of companies raising money which was 3315 in 2000/01, during the dot com boom), raised a record total of slightly over £1.86 billion, £225 million or 14% higher than the previous year of 2013/14.

The record amount raised has been attributed to pensions becoming more restrictive for higher earners and the reduction of the lifetime allowance. We discuss this further in the 2016/17 update of our EIS Industry report which is due for release shortly.

First time and follow on fundraising is about equal, with follow on fundraising increasing over the last several years, no doubt buoyed by the success of their initial raises. And just over £1.3 billion of income tax relief was claimed by a total of 29,380 EIS investors. This gives an overall average investment amount of just under £44,500. In fact, 80% of EIS investors made a claim for tax relief in respect of an investment of less than £50,000. 135 investors made a claim for tax relief against a £1million EIS investment and 1830 against a £500 EIS investment. This is a good advert for the versatility of EIS in terms of the range of capital that can be committed and that there is take up on both ends of the spectrum, although the most common amount on which tax relief is claimed is £50,000.

The Energy and Water sector has the highest average raise amount of £1.83 million (more than twice the amount of the next highest average raise at £770,000 for Construction) and this is hardly surprising given that this is an important part of UK infrastructure provision. But it also experienced the largest decrease in funds raised between 2013/14 and 2014/15 with a drop of £34 million. This may have marked the start of the decline in renewable energy projects.

Business Services companies have recently become much keener on EIS, with the amount raised increasing by almost 60% or £224 million between 2013-14 and 2014-15 and the number of companies raising funds increasing by 43% or 285 to 955. This coincided with a surge in the growth of the sector, (which encompasses the wide range of work that supports a business from IT to shipping and finance) and meant that by 2014/15, Business Services firms accounted for over £600 million, or more than one third of EIS investment.

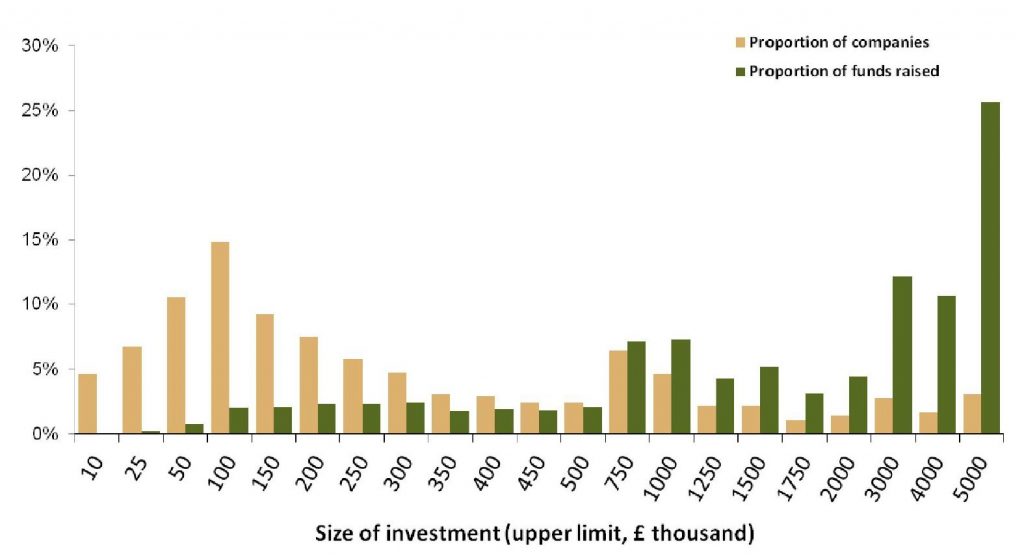

For us, though, details of how the money raised through EIS is distribution amongst those raising it, provide, perhaps, the most interesting insight into the EIS market; around half (46%) of the companies raising funds under EIS in 2014/15 received investments of £150,000 or less, making up just 5% of the total investment amount received by all EIS fundraisers in that year. While just 14% of the overall number of companies raised amounts over £1 million (two thirds of the total investments made into EIS).

Distribution of the Proportion of funds raised under EIS (number of companies and amount raised) by upper limit of size of investment (2014/15)

Source: HMRC EIS Statistics (October 2016)

The graph above suggests that a firm attempting to raise less than three quarters/£1 million through EIS is currently struggling. We suspect that this is most seriously affecting mid-size firms, with smaller companies looking for up to £150,000 or less able to top up their funding with friends, family and contacts and larger entities able to approach funds to source their finance of £1 million plus. The companies which sit in the middle ground, which are perhaps past the initial start-up stage and in early trading, ready for scaling up, with a requirement of more than £150,000 may well find themselves and their monetary needs too big for friends, family and contacts to fulfil, but too small to be worthwhile for fund managers.

If this is the case, the drive to push EIS money towards earlier stage, more risky firms and scale ups seems understandable.