Hotel and Resort Property Product Provider Survey

Intelligent Partnership will soon release an in-depth sector report looking at Hotel and Resort Property. This report is part of the Alternative Investment Report (AiR) series and is aimed at financial advisers, property professionals and sophisticated investors who have an interest in the sector.

As part of this report, we identified and surveyed over 200 property developers and product providers. The survey included a range of questions looking at the type of investment, stage of development, occupancy, SIPP acceptability, returns, distribution and sales.

We received a 21% response rate to the survey which has provided a large amount of information and allowed us to highlight a number of trends which will benefit readers of the report.

Unfortunately a 21% response rate shows that a large number of product providers were unwilling to openly provide information on their projects and this is a worry, as it could put financial advisers and investors off alternative investments in the future.

Here is a breakdown of some of the findings from this survey.

About the Investment

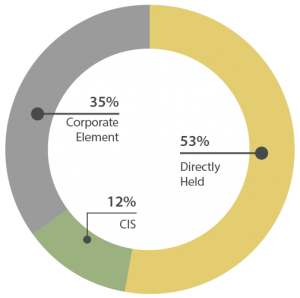

Investment Structure

Source: Intelligent Partnership

Directly held property, which gives investors ownership through a leasehold or freehold title, accounts for the largest proportion of the sector (53%). Investors can also gain access to hotel and resort property through investments with a corporate element (bonds, loan notes and special purpose vehicles) or collective investment schemes.

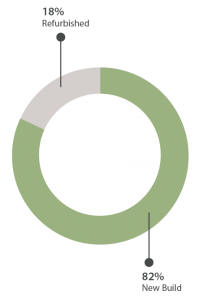

Type of PropertySource: Intelligent Partnership

The vast majority of investments are new build properties (82%) with a number of these being sold off-plan. This means investors may have to wait a number of years for the property to be built before they start to receive returns.

Nearly half (47%) of respondents have changed the price of the investment since it was launched. Of this, just over 60% increased the price due to demand, quality and the type of client attracted to the investment. The remaining 40% lowered the price due to the economic situation and lower than predicted demand.

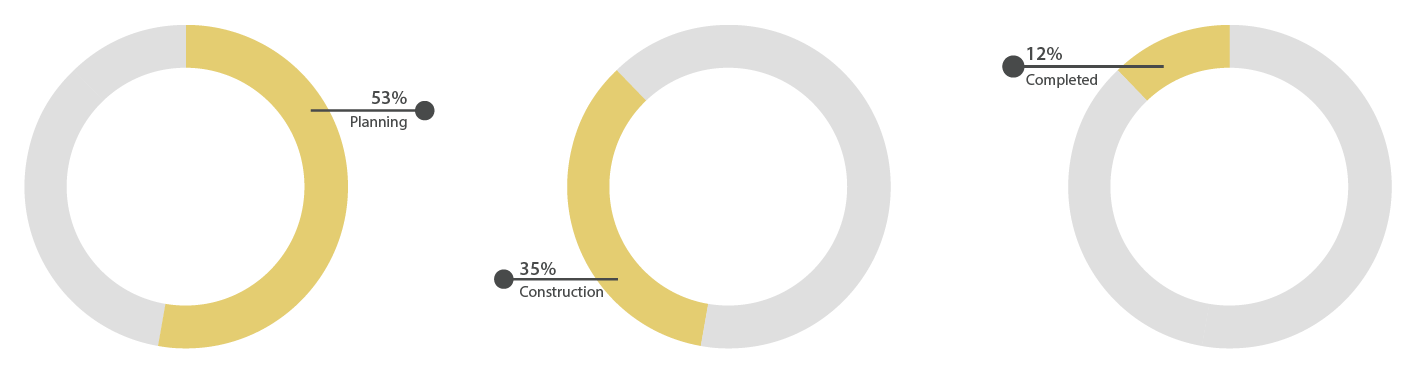

Stage of Development

Development stage of projectSource: Intelligent Partnership

A large number of underlying properties are still in the planning stage (53%), with 35% under construction and only a small number (12%) completed.

Less than a quarter (24%) of respondents expect building works to be completed on time. Nearly 30% said that there had been (or they expect) a delay with almost all of these expecting the delay to be longer than 12 months. The remaining respondents did not give an answer to this question.

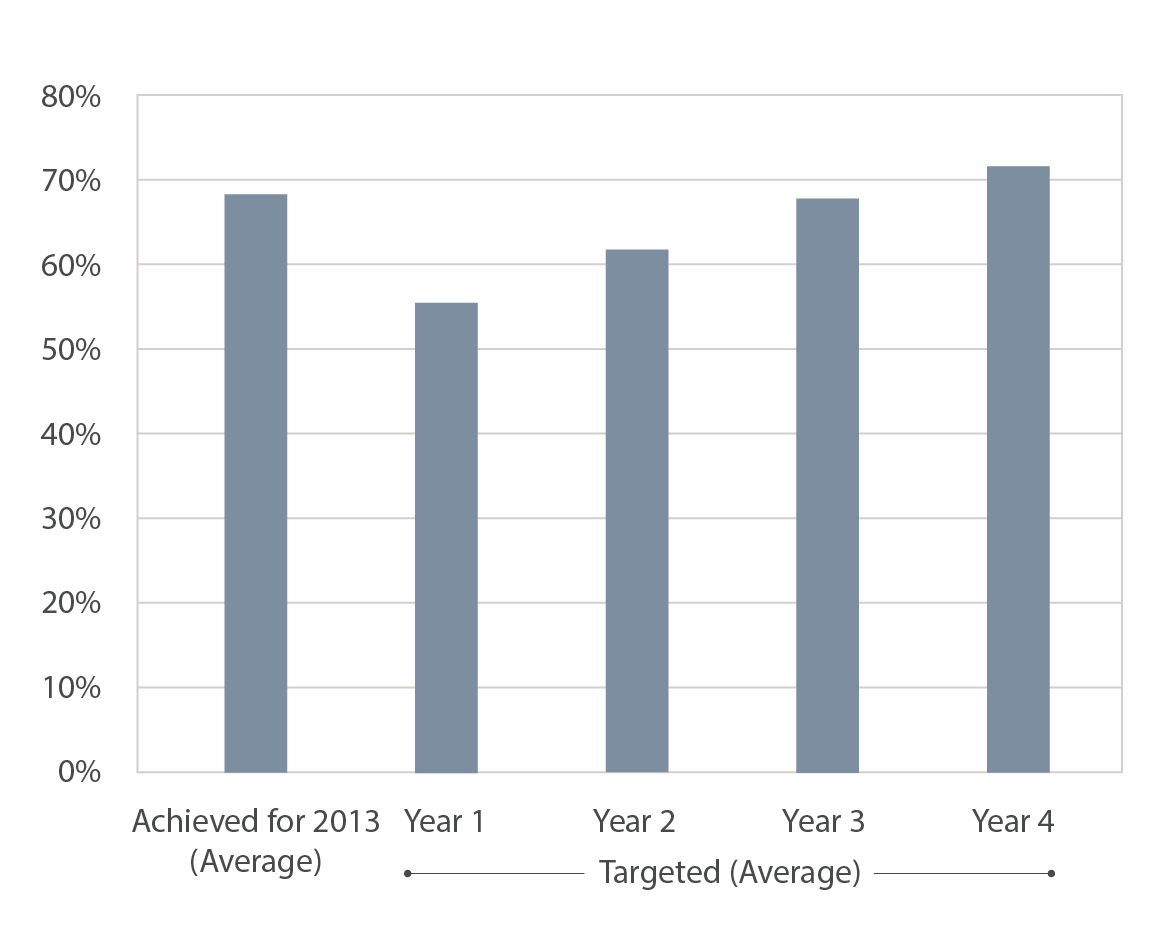

Occupancy

Achieved vs. Targeted OccupancySource: Intelligent Partnership

We also looked at average occupancy (for those properties that have opened) versus predicted occupancy for the first four years of operation. The average occupancy achieved for 2013 (to date) was 69%. This is strong compared to the average targeted occupancy rates which range from 56% in year 1 to 72% in year 4. These occupancy targets are high compared to average global occupancy figures for the sector which range from 50 to 70%.

SIPPs

The use of SIPPs for investment into hotel and resort property is widely documented and has been looked at in detail in the report.

41% of respondents said that their investment was able to be held within a SIPP. Responses seem to indicate that there has been a reduction in SIPP investment activity in 2013 due to increased regulatory scrutiny on the sector. This supports issues highlighted in this report.

However, it is clear that SIPPs are still a strong driver behind the sector. Based on those investments that are SIPP acceptable, 68% of investment volume came from SIPPs with the remaining 32% from cash investors.

Returns

Only 18% of investments that completed the survey offer guaranteed returns, with returns ranging from 7-10% per year. The remaining investments either offer a fixed return (which isn’t guaranteed or underwritten) or variable returns depending on the performance of the property.

Distribution

Over 70% of investments are marketed to investors as well as lifestyle purchasers. Investors account for an average of nearly 70% of investment volumes with the remaining 31% from lifestyle purchasers.

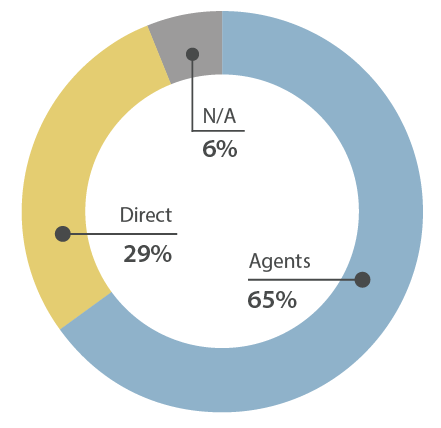

Direct vs. Agent distributionSource: Intelligent Partnership

Distribution through property agents and introducers is the most popular method. Based on those surveyed there is on average 30 agents distributing each property investment.

Sales

Nearly 60% of respondents have not made any sales to date. Out of the 41% that have made sales, nearly a third said that sales during 2013 were worse than they had been expecting. Nearly 90% of these feel that 2014 will be better or much better than 2013, with the remaining 10% feeling that 2014 will be pretty much the same.

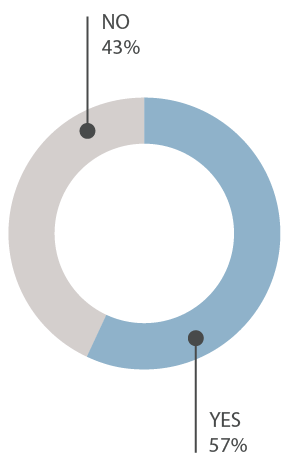

The effect of UK regulatory changesSource: Intelligent Partnership

Nearly 60% of those who have made sales to date believe that they have been adversely affected by recent regulatory changes in the UK. The main reasons given include that there is more caution in the marketplace, the impact of RDR has slowed sales, and high profile failures in the sector and the heavy handed responses to this by the regulator have scared investors.

Other Investment Projects

Finally, over half (53%) of respondents have another hotel and resort property investment available to investors, with 65% having a further property investment in the pipeline.

Conclusions

Some of the key points to take from this research include:

- The majority (53%) of the investments in this sector are into directly held properties

- Over 80% are new build properties (including off-plan investments)

- Only 12% of investments surveyed were completed, with the majority (53%) in planning and 35% currently under construction

- Average targeted occupancy rates range from 56% in year 1 to 72% in year 4

- 41% of respondents said that their investment was able to be held within a SIPP

- Only 18% of investments surveyed offer guaranteed returns

- Distribution is primarily (65%) through property agents and introducers

- Nearly 60% of product providers believe that sales have been affected by recent regulatory changes in the UK

- 65% of respondents have a further hotel and resort property investment in the pipeline

This survey has highlighted some important information for financial advisers who have clients invested in the sector and anyone who has a vested interest in hotel and resort property. We were though disappointed with the response rate and the lack of participation from a few well known hotel and resort property investment providers.

Our feeling is that cooperation between alternative investment providers and the financial services community brings about greater transparency and ultimately strengthens the sector.

Intelligent Partnership produce content, education and training for financial advisors and professionals on directly held alternative investments, UCIS, EIS, crowdfunding and peer-to-peer lending. This includes the Alternative Investment Report (AiR), an annual publication looking at the entire alternative investment sector, along with bi-monthly reports looking at specific investment sectors. For more information please contact us: reports@intelligent-partnership.com.