EIS investors may not have immediate access to tax relief when investing in an EIS portfolio. Some EIS investment managers are taking 18 months or longer to deploy investor’s capital.

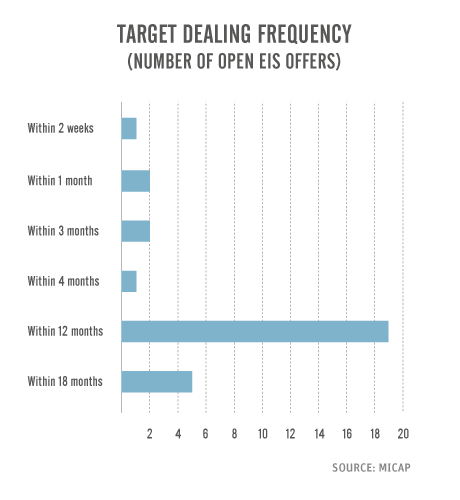

According to data from MICAP, the most common target deployment time is within 12 months, with 19 managers quoting this time-frame.

The data also shows that five managers target a deployment time of 18 months, while some managers claim they will have invested all of the client’s capital within two weeks.

A longer target deployment time should be a serious consideration for investors when selecting an EIS offer.

No instant tax relief

Investors will only receive tax relief when the investment manager has deployed their capital. The investor will need an EIS3 form (or EIS5 form for HMRC approved funds) for each underlying investment in the EIS portfolio to qualify for tax relief.

Currently, EIS investors can qualify for 30% income tax relief, as well as CGT deferral, IHT relief, and loss relief.

Managers are finding the right deals

Investment managers will be reliant on there being suitable dealflow available, and this is not necessarily guaranteed.

There is certainly no shortage of opportunities, but managers will have to do their due diligence to find investments that have the best growth prospects for their clients.

For example, Oxford Capital’s Growth EIS IM suggests that the manager receives applications from “well over 2,000 companies every year”. However, the firm will whittle that down to around five or six investments per year.

With the risk-to-capital condition that was implemented in the 2017 Autumn Budget, EIS managers have to purely focus investment on growth capital opportunities. This means that low risk capital preservation plays are no longer a feature of the EIS landscape.

It may take a greater amount of time for managers to find opportunities that both comply with the new rules, and deliver attractive returns to investors.