HMRC has struggled to maintain its efficiency: statistics on AARs data

Last week HMRC released data on the Advance Assurance Requests (AARs) for the first time.

Companies considering raising investment through EIS or SEIS can apply for the Advanced Assurance from HMRC prior to issuing shares. An approval from HMRC means investors can be certain that a company’s shares will qualify for the EIS or SEIS when issued (provided that they do not deviate from the plan they presented to HMRC and undertake non-qualifying activities of course).

Advance Assurance Requests

The release contains data on the number of AARs applications received, and the data are presented in two groups. The first group is the number of applications processed in the year received, while second group is the number of applications processed in subsequent years.

There are three outcomes for each application received. In addition to approval or rejection from HMRC, some applications were withdrawn and not pursued further. Based on the raw data, we investigate the proportion of each outcomes in each year and the efficiency of HMRC in dealing with AARs. We also discuss the probability of obtaining the assurance.

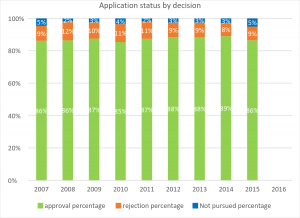

On average, 87% of all applications were approved by HMRC. There was about 10% rate of rejection, with the remainder not being pursued further. As we can see from figure 1, these percentages have been very stable in the last 8 years and therefore we expect to see this trend continue.

In contrast, HMRC has struggled to maintain its efficiency in processing AARs.

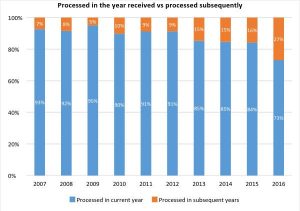

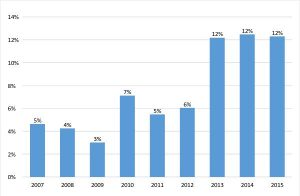

Figure 2

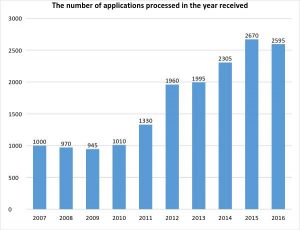

The proportion of applications processed in subsequent years has increased over time. The percentage in 2016 (27%) is more than 5 times higher than HMRC’s most efficient year where only 5% of applications received in 2009 processed later. The absolute number of applications processed in 2016 has also declined from 2015 (Figure 3).

We can speculate that HMRC reached its maximum capacity in 2015/16 and without hiring more staff the maximum number of applications it can deal with in a year is around 2600. If the number of applications increases at the current rate, we may see more and more unprocessed applications. Alternatively, the slowdown in 2015/16 could be related to the changes in the legislation that govern EIS and SEIS. It may be that HMRC were awaiting the final details of the legislation before processing applications, or it may be that assessing companies against the new rules takes longer. Time will tell.

Figure 3

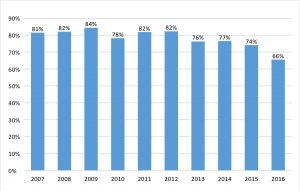

Figure 4: Percentage of AARs approved in the year submitted

Whatever the reasons for the reduced efficiency in HMRC, if this continues then there is a lower probability of obtaining an approval from HMRC in the same year that an application is submitted.

Out of all applications submitted in 2016, only two thirds of them obtained the assurance from HMRC in the same year. Before 2012 the proportion was in average more than 80%.

Figure 5: Percentage of AARs approved in subsequent years

Although HMRC has become slower at granting assurance, qualifying companies can still be approved in subsequent years. Figure 5 shows that the proportion of companies approved in subsequent years has doubled in 2013.

Conclusions

The growth of the EIS scheme and the changes in the legislation governing it may be putting increased pressure on the Advanced Assurance process. This presents a challenge for firms raising money, as a delay in obtaining the assurance will translate into a delay in getting funded – Advanced Assurance can be a key factor for investors and they won’t commit if it is not in place.