Understanding Risk

I like this article: http://www.ftadviser.com

It’s got a good take on risk and what it means and it identifies something that bugs me – the financial services industry don’t use the same definition of risk as their customers. It’s a big, crucial disconnect.

The financial services industry uses volatility. Consumers want to preserve and grow their wealth.

For example, a fund that targeted a return of 2-3% a year with very low volatility would be defined as low risk. A low risk investor might be put into that fund, and 5 years later find that that they had a made a loss after inflation. I mean the fund could have made a negative return with low volatility, and it would still be defined as low risk. Would that meet the investor’s interpretation of low risk?

Or perhaps a client says that they are low risk and therefore does not like volatility in their portfolio. But if they are saving for an objective 20-30 years in the future (retirement) short-volatility is irrelevant, if over the long term they are likely to achieve their target. Avoiding volatility in the early days of the investment strategy will depress their annual returns and reduce the size of their eventual pot. The client needs educating here.

As the article points out ‘the investment industry has no common language to relate investor objectives to investment solutions’.

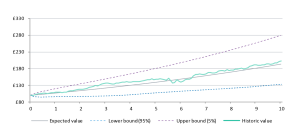

I think visuals help – this is a projection of the expected return and the upper and lower bounds of expected volatility for one of the model portfolios we promote. (The upper and lower bounds are two standard deviations from the mean, statistically 95% of annual returns should fall within these boundaries) This is based on real data, and showing a client something like this can help them visualise how much risk they are exposing themselves to, and for how much reward.

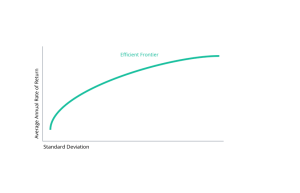

I think the efficient frontier is also a useful visual. By identifying where a portfolio sits on the efficient frontier, clients may be able to see that they need to take on more risk to achieve the level of return they need. Or conversely, it may help them understand that they can reduce the level of risk they are exposed to and still meet their objectives.

Of course all of this is theoretical and the real world is more complex. But I do think it helps explain the basic concepts that investors need to get to grips with.

Thanks

Dan