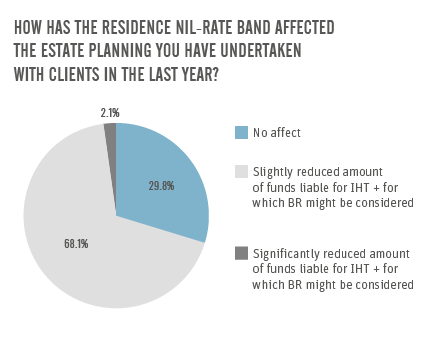

Nearly 30% of financial advisers say that the introduction of the RNRB (residence nil-rate band) has had no impact at all on BR (Business Relief) subscriptions.

According to a recent Intelligent Partnership survey of over 50 financial advisers, the introduction of the RNRB has not been drastic on BR subscriptions. Approximately 68% of advisers said there was a slight reduction in the amount of funds liable for IHT, and thus for which BR might be considered.

Only 2.1% of advisers saw significantly reduced funds for which BR might be considered. This suggests that BR is mostly used in instances where the estate is worth over the threshold of the RNRB. It also suggests that BR is, more often than not, the preserve of HNWIs.

According to HMRC, in 2015-16 there were £1.6 bn worth of IHT exemptions via BR, with 2,190 estates qualifying for the tax relief.

How the RNRB extends IHT relief

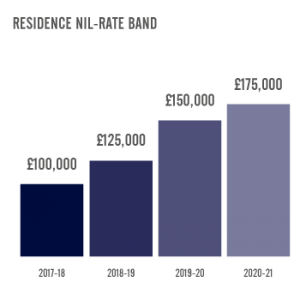

The RNRB was introduced in April 2017 to exempt a portion of the value of a home from IHT, and can be used on top of the nil rate band allowance of £325,000 per person. In the 2018/19 tax year, the portion is £125,00. This will increase by £25,000 every April until 2020, where it will reach £175,000 per person (and therefore £350,000 per couple).

Although the RNRB is certainly helpful in mitigating an IHT bill, many people’s estates will still be liable for IHT, especially if they have built up assets by owning a property in London or the south east.

The government received a record £5.2bn from IHT receipts in 2017/18, and this figure is projected to exceed the £6bn mark by 2021/22. The integration of BR as an estate planning option will clearly continue to rise in popularity in the coming years.

Learn more about the BR market

To learn more about the current BR landscape, read the latest edition of our Business Relief Industry Report.

To learn more about the current BR landscape, read the latest edition of our Business Relief Industry Report.

Our latest BR report looks at the environment that surrounds this tax efficient vehicle, including how it is providing much needed patient capital to UK businesses, the significance of BR against the backdrop of an ageing population, the significance of the AIM market in BR, as well as the latest compliance considerations that advisers should be aware of.

Readers will also be eligible for up to four hours of CPD.