Growing Sale and Lease-back Popularity Providing Routes to Long Income

Whilst reviewing the long income property sector for a soon to be released bespoke alternative investment report, we came across the striking increase in sale and lease-back deals in commercial property; the last decade has seen significant growth in this market, culminating in a record £450 million of transactions in 2015.

The upshot is that companies don’t just sell their capital assets as a last resort in times of economic adversity, but they also do it when a strong investment market creates high property prices and allows the release of large chunks of equity for business expansion. And, not only does it serve the need for corporate entities to raise cash, it also allows investors to secure longer-term, stable income streams, – a perfect property asset for long income.

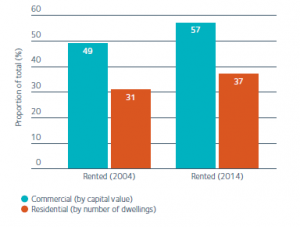

Over half of the UK’s commercial property is rented by occupiers (compared to residential where almost two-thirds is owner-occupied) and the decade to 2014 saw a notable development in business renting.

Commercial buildings for rent and residential rental growth 2004 to 2014

Source: Property Industry Alliance, Property Data Report 2015

The high levels of sale and lease-back activity during the peak of the financial crisis in Europe show that this type of transaction has tended to be contra-cyclical – i.e. more common in tougher economic environments. But, the more recent deals in a much more robust financial climate are more of an indication of the increasing reluctance of firms to commit capital and management time to the owner-occupation of their property, and of investors healthy appetite for commercial buildings.

Operational businesses see the benefits of ground rent structures which allow them to retain control of the asset whilst taking in significant capital. And, even better, a lease of the typical ground rent period of 125 years still qualifies as collateral against which to secure traditional real estate lending. Perversely, this makes the deal even more attractive to investors, who know that, for the small proportion of the asset value that constitutes the rent (perhaps as low as 5%), no mortgage lender would allow the landlord to exercise its reversionary right to cancel the lease in the event of non payment. They would simply step in and pay it. That’s a pretty secure income stream over a very long period!

Partly driven by the impressive recovery of the commercial property market, which has yielded impressive double digit returns for the last three years, it’s not really surprising that companies and investors have been keen to get involved. The fierce competition for good value has led investors to look outside of office premises (traditionally the stronghold of sale and lease-back transactions) moving the phenomenon into other alternative commercial property assets. As a result, there is now a far more diverse range of corporate entities selling off assets on a sale and lease-back basis, from supermarkets to hotels and cinemas to the ground-breaking February 2016 care facilities agreement between Alpha Real Capital and CareTech PLC. The deal, billed as the first such arrangement in the care sector, saw Alpha Real Capital pay £30 million for a portfolio of 41 care facilities, on a 150 year ground lease, with CareTech PLC to use the cash to support its growth strategy.

The income growth strategy of the buyer will also benefit from a net initial yield of 3.4%, (£1.07m per annum) which is virtually guaranteed to at least match inflation by rising with the Retail Price Index on a five yearly compound basis at between 0% and 5% per annum. This type of indexing of rent reviews has become the norm.

Still wondering why operational corporations and commercial property funds, especially those looking for secure long term returns, like sale and lease-back?

If you are interested in another forms of income grow and savings, check 529 college savings plan and other options.