Is your client thinking about making a gift to their children or grandchildren? You will likely have come across the “seven year rule”, but there are various other conditions and options that should be considered with gifting.

Inheritance tax (IHT) has become a hot topic with recent figures from HMRC revealing that receipts reached a record £5.2bn in 2017/18.

A frequently referenced way of mitigating IHT is to gift assets directly. The gift is made during the donor’s lifetime, then if the donor lives for seven years, the gift will be exempt from IHT. This is referred to as a Potentially Exempt Transfer (PET).

What is a gift?

HMRC guidance states that, from an IHT perspective, “A gift can be:

- anything that has a value, such as money, property, possessions

- a loss in value when something’s transferred, for example if you sell your house to your child for less than it’s worth, the difference in value counts as a gift.”

What if you don’t live for seven years?

If the donor doesn’t survive for seven years after a PET, the exemption fails. The gift would then be subject to IHT.

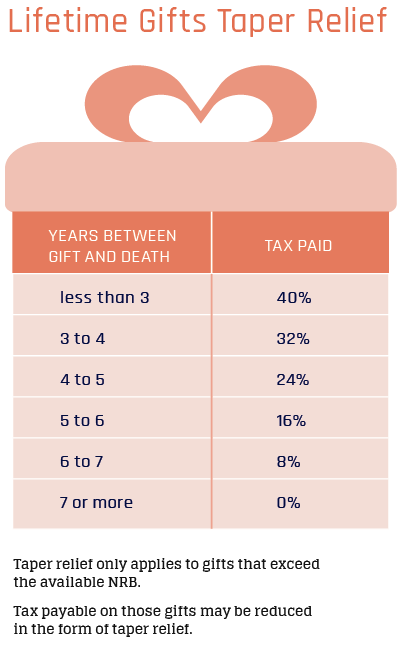

However, there is Taper Relief available. Taper Relief on gifts means that the longer the donor lives for, the less IHT the estate will be liable for.

If the donor lives for less than three years, then the full 40% rate of IHT will be due on the gift. However, if the donor lives for six years, only 8% tax would be payable on the gift.

It’s worth noting that IHT will only be payable on assets that are in excess of the nil rate band (NRB). The NRB allowance is currently £325,000 per person. For example, if a parent gifted £500,000 to their child and died within three years, IHT would only be payable on £175,000. At the current IHT rate of 40%, the tax due on the gift would be £70,000.

Another option – gifts out of income

A PET is a gift from the donor’s capital. However there are also IHT exemptions available for gifts out of income. Regular lifetime gifts out of after-tax income are immediately exempt for IHT purposes. This makes it irrelevant whether or not the donor survives for seven years or what the individual’s available NRB is.

There are a few requirements for the exemption to apply:

- The gifts must be regular and part of normal expenditure. Evidence of an intention to make regular gifts over a period of time should be available. This could be in the form of a letter.

- The gifts must be made out of net income after tax payable on salary, dividend income from shares, etc. However, the gifts will not be exempt if they are from the capital content of a purchased life annuity, or from the sale of investments.

- The amount gifted must leave the donor with enough income to maintain their normal standard of living without resorting to capital to meet living expenses.

A gift out of income can be used in conjunction with other exemptions and with trusts.

Other gift allowances

Annual exemption

Donors can transfer up to £3,000 per tax year in gifts. This can be carried over from the previous tax year, with a maximum exemption of £6,000.

Gifts to spouse or civil partner

As a general rule, transfers between spouses are exempt from IHT. However, a limited spouse of £325,000 applies to transfers from a UK domiciled individual to a non-domiciled spouse.

Gifts for national purpose or public benefit

Including gifts to UK-based charities, political parties, universities.

Gifts up to £250

Up to £250 per person, including other IHT exempt gifts such as a wedding gift or gift that counts towards the annual exemption.

Wedding / Civil Partnership gifts

Up to £5,000 for a child, £2,500 to a grandchild/great grandchild, £1,000 to anyone else. These must be given on or shortly after the event.

Payments to help with another person’s living costs

This might apply to an elderly relative or a child under 18.

The downside of gifting

One of the features of gifting is that the transferred assets are no longer part of the donor’s estate. This means that the donor cannot change their mind at a later stage if they realise they need the money.

Many people underestimate the amount of money they require in their old age to upkeep their lifestyle, especially if they live into their 90s and beyond. There may also be the need to pay for medical or residential care. In 2016-17, the average weekly cost of a room in a residential home in the UK was £600, and a room in a nursing home cost £841.

There are various alternatives to gifting. These include the use of trusts and investment options such as Business Relief (BR) and the Enterprise Investment Scheme (EIS).

In all likelihood, gifting will be used in conjunction with other estate planning tools.

Your ultimate guide to estate planning

For more comprehensive detail on gifting, as well as the other estate planning options available, read our latest guide – A Professional’s Guide to Estate Planning.

For more comprehensive detail on gifting, as well as the other estate planning options available, read our latest guide – A Professional’s Guide to Estate Planning.

The guide covers the different estate planning options available, as well as using illustrative case studies, and straightforward advice on developing professional relationships with financial planners and advisers.

Readers are also eligible for 4 hours of CDP upon completion of the guide.

Download a free copy of the guide here.