This week saw the Enterprise Investment Scheme Association’s spring seminar at the offices of PWC in London. The well attended event featured EISA Chairman, the Lord Flight, Richard Palmer (Grant Thornton), Philip Hare (Philip Hare Associates), Gillian Roche-Saunders (BWB Compliance) and Andrew Garside (Livingbridge) – all members of EISA committees. New Director General – Mark Brownridge – also addressed the audience.

Stephen Smith, PWC partner and Wyndham North, Head of Enterprise at HMRC completed the speakers.

The majority of the presentations focused on recent and upcoming changes to the EIS regulatory landscape. Although it may not feel like it, Gillian Roche-Saunders, Chair of the Regulatory Committee, reminded the attendees that, in terms of announcements of changes to the regulations governing EIS for retail investors, the last six months has been quiet.

This is probably a relief given all the changes to the legislation that govern EIS. Wyndham North echoed Richard Palmer’s comment that the reforms announced by the government in last year’s budgets are possibly the biggest changes to the EIS structure in its 22 year history. The speakers recapped the changes which came into force in April this year, including the removal of subsidised power generation as an EIS qualifying trade, the new lifetime investment limit of £12m per company (£20m for knowledge intensive companies), the 7 year age limit on investee companies (10 for knowledge intensive companies) and restrictions on company buyouts.

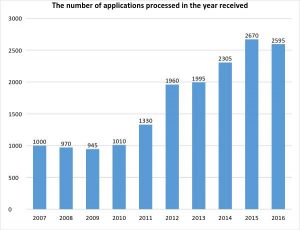

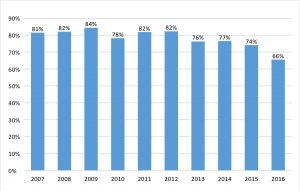

Moreover, in spite of the release of government guidance last week, the Chairman of the EISA Tax and Technical Committee, Philip Hare, reported that some of the rules are still not clear. In addition, the new “Growth and Development” test requires HMRC to study firms’ business plans. As a result, HMRC questions regarding advance assurance applications have increased and some firms have experienced long delays when going through this process. Wyndham North of HM Treasury also cited HMRC funding restrictions and the fact that Advance Assurance requests have doubled in the last five years as reasons for delays.

The number of applications approved in the year submitted

He also confirmed that all of these amendments demonstrate the government’s intention to target funding towards earlier stage, innovative, riskier firms, and announced the planned expansion of Social Investment Tax Relief in the next twelve months.