This was an article I wrote for Moneyfacts Life and Pensions issue this month:

Business Property Relief in Comparison to Other IHT Solutions

Dan Kiernan, Research Director at Intelligent Partnership, takes a look at how BPR products fit into the picture for advisers looking to mitigate IHT bills.

With the Inheritance Tax (IHT) threshold frozen and house prices rising, it is estimated that 5,000 more estates a year will be liable for IHT by 2018, an increase to 10% of households from just 2% in 2012. So mitigating IHT is no longer just a problem for the very wealthy, but now affects the mass affluent as well – specifically the baby boomer generation who make up the backbone of many advisers’ client banks.

However, traditional strategies for mitigating IHT, such as gifts and trusts, are not always flexible enough to cope with the challenges created by increasing life expectancy. It is very difficult for advisers to predict if the assets they plan on placing outside of their client’s estate will be needed at some point in the future – perhaps to fund a longer than expected retirement or provide for residential care. Many clients are also put off by the seven year time frame before traditional solutions provide 100% mitigation, the perceived legal complexities and the necessity of ceding control of the assets.

These are some of the key drivers behind a quiet but meaningful increase in the market for a new range of investment products that provide BPR products. Known as Inheritance Tax Services, Inheritance Tax Solutions or Estate Planning Services, these products utilise Business Property Relief to help advisers mitigate the impact of inheritance tax on their clients’ estates.

According to Investors Choice Lending, BPR products are riskier than the traditional solutions, but they are easier to implement, provide better access and more flexibility, offer relief in a much shorter timeframe and offer a wide choice of investment strategies that hold out the prospect of meaningful growth as well.

So how do BPR products compare to more conventional IHT solutions? Well, broadly, there are two ways to reduce IHT liabilities:

- Asset reduction strategies, where steps are taken to reduce the value of the estate

- Asset replacement strategies, where assets that are liable for IHT are replaced with exempt assets. IHT solutions that utilise BPR are would be part of an asset replacement strategy

Let’s examine the options available in each of these strategies in turn, and then see how BPR products stack up alongside these other solutions.

Asset Reduction Strategies

Charity

We haven’t included charitable legacies in our table below, but we should mention them for the sake of completeness. If 10% of an estate is left to a registered charity, there is a 4% deduction in the rate of inheritance tax from 40% to 36%. It’s also worth noting that donations to charities or political parties made during the donor’s lifetime are IHT exempt.

Gifts

Gifts cover a wide range of possibilities. Smaller gifts of up to £3,000 annually are exempt from IHT. It is also possible to make gifts from income, provided that it can be demonstrated that they are:

- habitual

- made from post-tax income and

- leave the donor with sufficient income.

This is a surprisingly underutilised relief.

ore common (and included in our table below) are Potentially Exempt Transfers (PETs) where they are subject to IHT on a sliding scale: three years from the date of the gift there is 20% IHT relief, and the relief increases by 20% every subsequent year until 100% relief is achieved after seven years.

Gifts are relatively simple to implement, but specialist knowledge is required to ensure that the tax consequences are understood; that the donor can afford to make the gift and that the record keeping is accurate in case of a challenge from HMRC when the estate is assessed for IHT relief. The process of making the gift should not be expensive, although of course the advice has to be paid for.

The biggest issue with gifts, apart from the time it takes to achieve 100% relief, is the loss of access and control. The gift becomes the sole property of the beneficiary (a gift without reservation) as soon as the gift is made and the donor has no legal claim on the assets or income (or any other benefits). This can be a concern if the donor anticipates that they might need the money in the future, or if they feel their intended beneficiary isn’t capable of managing the money responsibly.

| Table: Sliding Scale of Taper Relief on PETs* | |||

| Number of years from gift | % of IHT (Reduction in Tax Charged) | ||

| 1-3 | 100% | ||

| 3 | 80% | ||

| 4 | 60% | ||

| 5 | 40% | ||

| 6 | 20% | ||

| 7 | 0% | ||

*Note that this reduction only applies to the tax payable on the failed PET. The full value of any gift made within seven years of death would be added to the value of the estate, and the Nil Rate Band would be applied to the gift.

Trusts

Trusts are usually used in conjunction with gifts – a gift can be placed in trust. This places the assets in a legal wrapper that is controlled by the trustees. Trusts have all the IHT benefits of a gift, but give the donor (settlor) more control and mean they can potentially retain some of the benefits.

The settlor can specify when the assets are distributed to the beneficiary (usually upon their death where IHT mitigation is concerned, but this feature can also be used to delay distribution, perhaps to prevent youngsters spending money unwisely for example) and how those assets are invested prior to that. IHT is often immediately chargeable on transferring the assets into the trust and there may be a 20% upfront tax charge as well (chargeable lifetime transfer).

If the settlor wants to receive some benefit from the assets placed in the trust, then a discounted gift trust or loan trust must be used. These more complex legal structures allow the donor to receive income from the assets, but usually mean that something less than 100% IHT mitigation is achieved. And as they are based around gifts, the same timeframes apply – seven years until full IHT relief on the portion of the gift that is not reserved for the settlor’s benefit.

There are a wide variety of trusts and trust law is complex, so specialist knowledge is required here, and of course this complexity comes at a high price: setting up and running trusts can be expensive and is not worth considering for amounts under £100,000.

As with gifts, the biggest issue with trusts is the loss of control. Although the settlor can exercise some control and take some benefit from the trust, the assets are owned and managed by the trustees – if the settlor exercises control then it is likely that the arrangement will be deemed a sham trust and the full IHT liability will apply.

Discounted gift trusts are currently the most popular IHT mitigation strategy, favoured by over 70% of advisers according to FT research.

Asset Replacement Strategies

EIS

The Enterprise Investment Scheme is a long-standing government initiative to encourage investment into small and medium sized businesses. The rules which govern whether a company qualifies as EIS eligible are actually much stricter than the rules for BPR, so EIS qualification is de facto BPR qualification. That means that after two years the investment is fully exempt from IHT.

An investment into an EIS qualifying company has additional tax reliefs: investors will get up front income tax relief, CGT relief and loss relief. However, the stricter rules mean that EIS qualifying companies are smaller, higher risk companies, so these generous benefits can only be accessed if investors are prepared to take on more risk.

This is genuine risk warning – IHT mitigation cannot be a primary motivation for investing in an EIS because EIS are focused on growth, not capital preservation (there’s a reason why EIS have loss relief!)

For more information on EIS investments, download a complimentary copy of our 2014 EIS Industry report *here*

EIS and BPR

EIS and BPR are sometimes used in combination – if clients have surplus investable assets, an EIS investment is used to maximise the income tax relief, or defer tax on gains elsewhere, and the remainder is placed into a BPR products for the IHT mitigation.

Another possible combination is moving a client into a BPR product after they exit an EIS investment – retaining the 100% IHT exemption without having to restart the two year qualifying period. The three year BPR replacement assets window gives ample time to implement this solution. Limited life (“exit focused”) EIS can be used in this scenario – growing funds for a period of 4-5 years at the same time as qualifying for IHT relief, then moving them into a lower risk BPR trade, retaining the relief.

Finally, this could be attractive for EIS renewable energy investors. Renewable incentives are no longer allowable within an EIS, and there is not a comparable asset backed, low risk opportunity in the EIS universe. However, the renewable incentives are allowable when claiming BPR. The sorts of clients who invested in renewables via EIS, can now do the same via BPR.

Life Assurance

Life assurance falls into a slightly different category – it doesn’t mitigate the IHT bill at all, it simply sets aside some money to pay for it so that the estate can be passed on intact. Generally the policy is written in trust and the pay-out is made outside the estate, so the death benefit is used to meet the IHT liability. It can be paid for with a single lump sum or monthly premiums, but the cost of the policy and access to this product will depend upon the insurer’s assessment of age, lifestyle and health status – in cases of poor health it may not be available at all.

How Does BPR Compare?

BPR is an asset replacement strategy.

The two biggest advantages BPR has over the other solutions available are that it doesn’t entail any loss of control and it is 100% effective within two years.

Another big benefit is the simplicity of the solution – no complex legal structures or careful planning of the amount and timing of gifts is required and there is no need to grapple with POAT (Pre-Owned Asset Tax) or GWR (Gifts With Reservation) provisions.

However, the investment capital is still at risk. This is a double edged sword of course – the downside risk comes with the potential upside of growth and income.

Investors with enough wealth and sufficient income are likely to want to use up their gifts-from-income allowances first and foremost and more cautious investors may still prefer to use trusts to keep the assets in very low risk assets. But planning for long lives is difficult and the flexibility that BPR investments offer cannot be ignored. At the other end of the scale, clients who want swift IHT mitigation should also be considering BPR.

Appendix: Scope of IHT Reliefs

Inheritance tax is an example of a tax which under HMRC’s definition, provides progressivity in the tax system by ensuring the burden falls most on those who can most afford to pay. It is unlike most other taxes in that the amount of relief far exceeds the amount of tax collected. Several reliefs define the scope of the tax and the value of these reliefs in 2012-13 was £22.4 billion, seven times the value of tax collected. The biggest relief is obviously the nil rate band, which accounted for £18.4 billion of relief in this period.

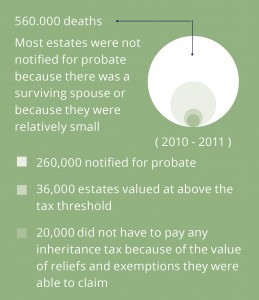

In 2010-11 (the last period we have complete figures for from the National Audit Office), there were 560,000 deaths. Most estates were not notified for probate because there was a surviving spouse or because they were relatively small. Of the 260,000 deaths that were notified for probate, 36,000 estates were valued at above the tax threshold. Of these, 20,000 did not have to pay any inheritance tax because of the value of reliefs and exemptions they were able to claim.

(Also read: If you have a small business venture which you are looking to expand, contact Greenbox Capital. The process of applying for loans and the criteria on the basis of which loans are sanctioned are explained here)