In April 2017, HMRC released their bi-annual update on EIS statistics. The report itself shows the basic changes and trends evidenced by the EIS data collected for primarily the 2015/16 tax year.

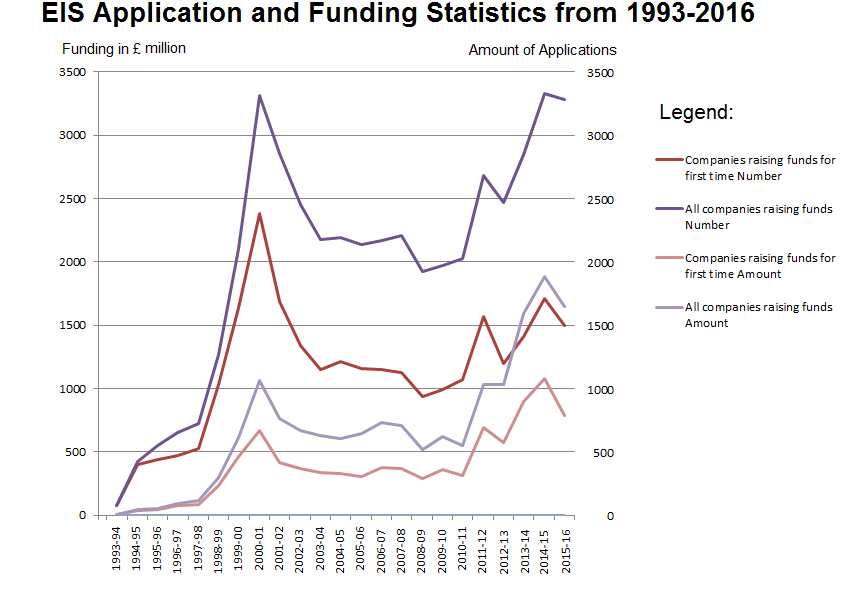

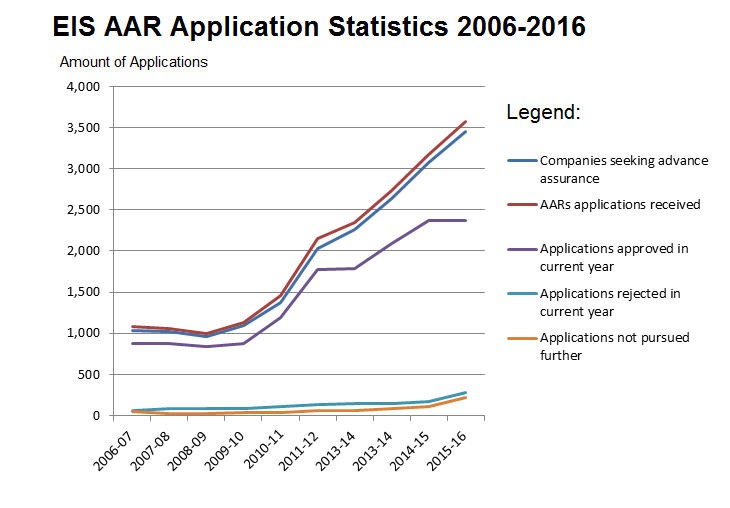

During this period, the amount of companies that were raising funds was 3285 (about 45 companies down from the previous year), the funds they raised amounted to about £1,657 million (about £233.8 million down from previous year), and the number of Advanced Assurance Request(AAR) applications was about 3570 (about 400 applications up from the previous year). These changes are largely attributable to the November 2015 policy amendments that made qualifying for EIS more difficult and meant that many of those investee companies that do qualify are now higher up on the risk scale. Historically, economic turmoil and change in legislation has been considered the main cause in trend variation. This time is no different, the change in government policy correlates to some of the changes in the amounts raised as well as the AAR applications.

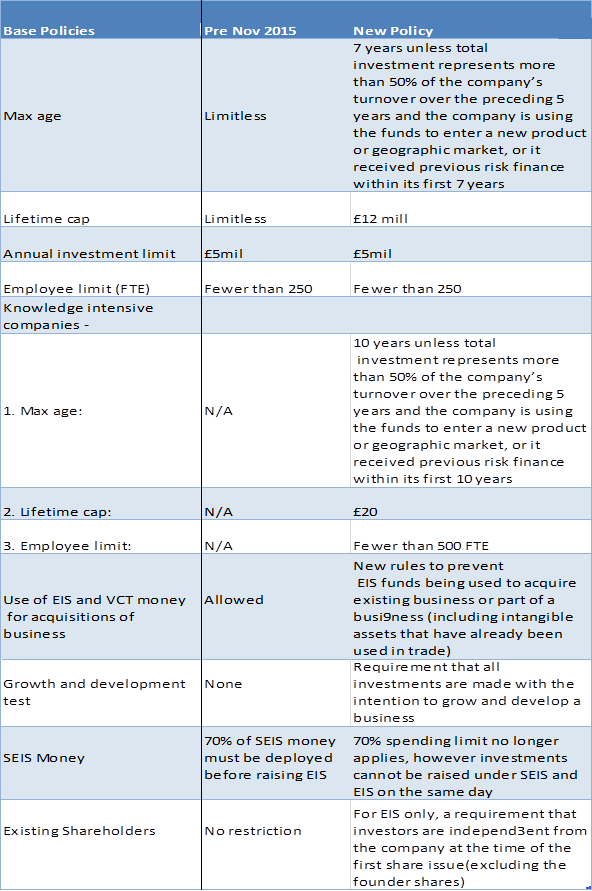

The purpose of the policy amendments include continued compliance with EU State Aid rules, and to focus aid towards funding earlier stage firms, as was one of the original intents of EIS. However, the restrictive effects of the 2015 changes have been considered as damaging by many in the UK SME arena. But, it is important to note that even with BREXIT; it is unlikely that the regulations will immediately change after the United Kingdom leaves the EU. The chart below gives a brief summary of the major impacting policy changes for EIS qualification.

The true impact of these policy changes will be shown in the coming years. However, some of the initial effect can already be seen in the movement if the data trends, specifically for the statistics on the number of companies raising funds and the funds raised as well as those applying for Advance Assurance.

The amount of companies raising funds for the first time as well as overall, decreased by about 14% and 1.37% respectively. This is likely due to the new restrictions discouraging some companies that no longer qualify for EIS. The chart below shows this dip, but this is not a new phenomenon; It is not unusual for new regulations to cause this kind of reaction; take for example, the 2007 income tax act which included a new independence condition which put further restrictions on investors wanting to take advantage of EIS relief. Another notable trend change came in 2012 with the introduction of SEIS, when, understandably, the number of companies raising money for the first time through EIS dropped. The upward trajectory of EIS investment has also been interrupted significant economic shifts. They include the dot com bust as well as the recent financial crisis in 2007/8 and it’s slow recovery.

The purpose of AAR is to pre-approve a company for EIS before it starts fund raising. This is an assurance that the initial structure and intended activity qualify for EIS reliefs. Although it is no guarantee that a company and its investors will be eligible for the EIS reliefs after the three year holding period, receiving AAR helps to boost investor confidence.

Looking at the data below in the graph, we can infer that the flat-lining in the number of approved AAR applications from 2014/15 was due to applicants no longer qualifying. In fact, if we look at the acceptance ratio of processed AAR applications in 2015/16 (not including the applications not pursued further as at least a proportion of these will be processed in a subsequent year) the number is at around 90%. This is almost a 5% drop from the 2013/14 and 2014/15 rates. The applications not pursued further increase could also be because of companies who no longer meet the requirements to receive EIS.

The continued growth of companies raising EIS funds has not been greatly impacted, with a drop of less than 1.5% and the number of projects seeking advanced assurance up by over 10%. However, this is offset to some extent by an uptick in the number of applications not pursued further and applications rejected.

It’s also worth remembering that the amount raised in 2015/16 was still second only to 2014/15 as the record year for EIS fundraising. So, there are some strong indicators that, although, as is historically the norm, legislative changes have created waves, the suggestion that it is the end for EIS, is a vast over-exaggerated.

The future impacts will be interesting to see, especially in relation to continued interest in the scheme and whether or not funds are actually being more targeted at earlier stage firms.