A survey of almost 200 financial advisers carried out for the new Intelligent Partnership AIM Industry Report has identified that 54% of advisers use AIM solutions some of the time, 10% use them frequently, while a third never use AIM. The survey examines the different approaches taken to AIM, based on how much advisers use it, and the results are enlightening.

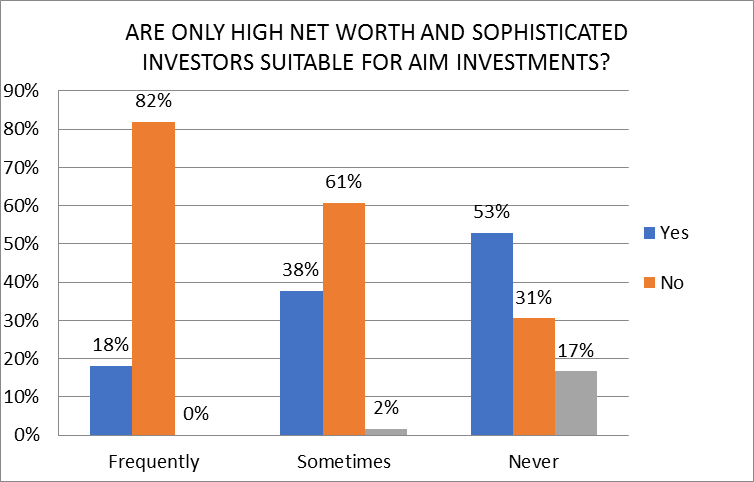

When looking at a breakdown of the adviser survey answers, the research found an inverse relationship between the frequency of recommending AIM investments and the proportion of those who thought that AIM is not just for High Net Worth Individuals and Sophisticated Investors; a higher proportion of those who recommended AIM frequently believed this was the case than those who sometimes used the market. And a higher proportion of those who sometimes used the market believe this is the case than those who never used it.

The suggestion is that the assumption that ‘AIM is only suitable for HNW clients’ is a misconception that pervades among advisers who are less familiar with the asset class. Veteran AIM investors acknowledge that AIM investments also add value to retail investors’ portfolios.

The differing opinions don’t stop there. Growth is clearly the most obvious reason to recommend AIM investments, but those advisers who do so more regularly clearly also value other facets of the market. In particular, 18% of frequent users picked income as one of their three top reasons to recommend AIM versus only 8% of Sometimes users who perhaps don’t entirely recognise the potential dividend opportunities.

Then there are the top three criteria when selecting AIM funds or shares. First, a higher proportion of frequent users picked transparency of underlying investments than Sometimes users. Sometimes users, on the other hand, were more likely to rely on performance history when choosing an AIM investment.

In addition, over a third of Sometimes users tended to prefer products from providers they had used previously, while less than 1 in ten frequent users listed this as one of their top three considerations. Instead, frequent users were keener on third party reviews. This may suggest that those with more experience of recommending AIM have greater confidence that encourages them to cast the net wider to identify the best opportunities.

There were also indications that less practiced users in comparison with more seasoned users, can overestimate the complexity of some issues such as suitability, while, at the same time, perhaps underestimating the importance of some less obvious issues at the point of investment, for example – exit risk.

Concerns regarding suitability didn’t seem to discomfort frequent users to the same extent. This suggests that, as they write more business in this area and become more aware of the regulatory requirements, advisers realise that these issues are not as complex as they may have originally thought. The same conclusion can also be applied to concerns around compliance and due diligence.

So, familiarity is a key factor for advisers when it comes to recommending investments on AIM. The signs suggest that the more experienced advisers are with recommending AIM investments, the more positive they are about doing it and doing it with a wider range of clients.

Thanks to online surveys big multinational companies are getting quick survey results and along with this, it is also helping people in making money from home thus acting as an additonal income for them.

Complimentary copies of the report are available to download here.