23

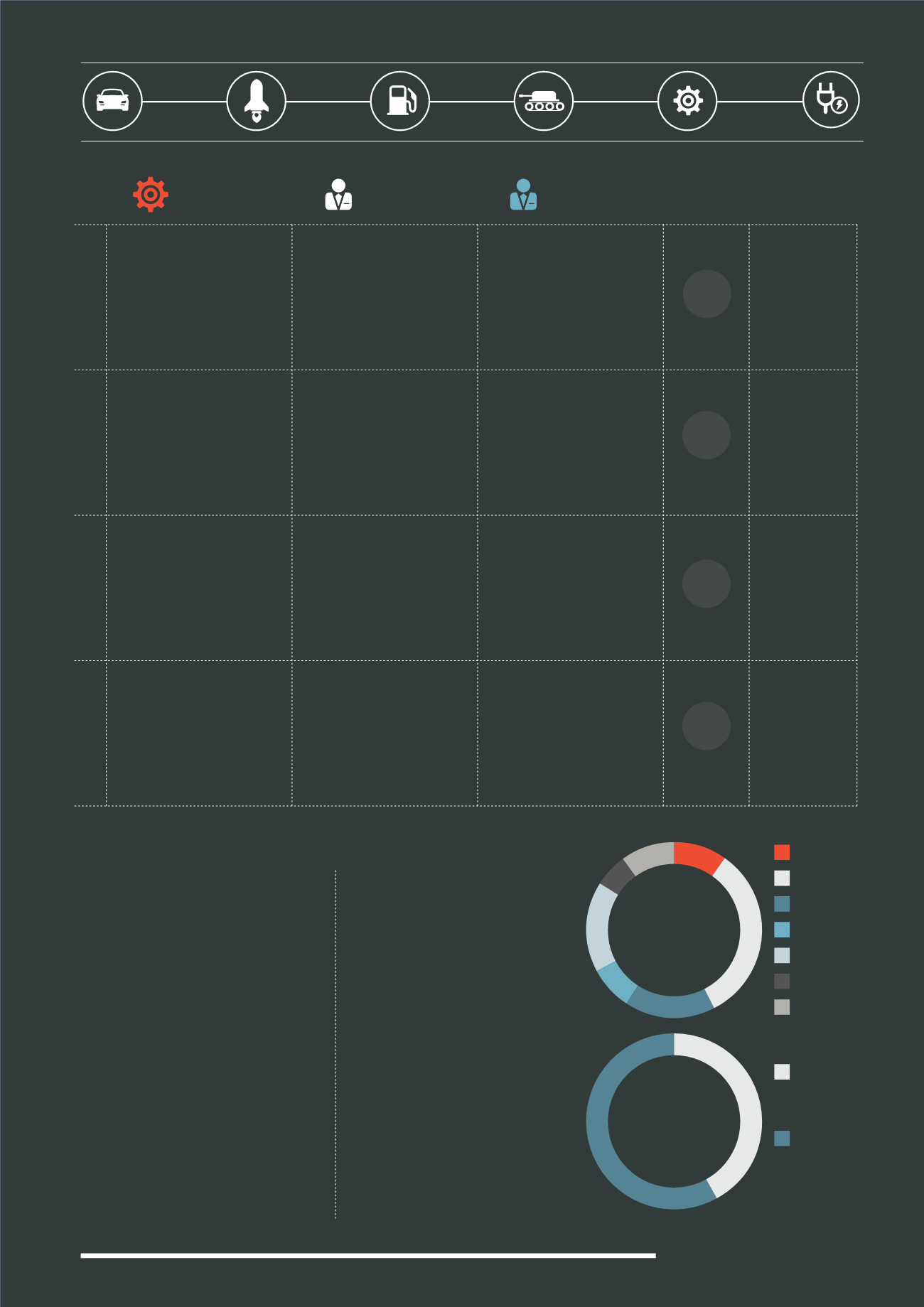

The published data shows that there

is a significant breakdown in the

distribution of deal values in the UK

Precision Engineering Market. Cyrus

IM’s research indicates that of the

deals done between 2013 and 2015

for the purchase of UK Precision

Engineering companies, only 10%

were in the value range of £5 million

or less. Additionally, at the £50 million

level and above (the level at which

Cyrus IM aims to sell its aggregated

businesses), there is significant

interest from both investment entities

and other Precision Engineering

companies, giving a valuable scope

for potential interest at exit.

Cyrus Investment Management’s

view is that “the UK Precision

Engineering sector is a market with

significant growth potential and one

in which Private Equity and global

industrial companies are acquiring

more significant stakes. The prudent

investment in best in class Precision

Engineering companies with exposure

to the UK’s world class exporting

industries offers investors diverse

exposure to a market with strong exit

and profit potential. Britain’s World

Class Precision Engineering market

is of significant interest to global

Private Equity funds and international

Engineering companies with over

£4bn of acquisitions on average

completed every year (since 2013).”

DISTRIBUTION OF DEAL VALUES

0.8x Revenue

3.88

APOLLO AEROSPACE

GROUP

JASON CRABTEE AND

ADRIAN ARSCOTT

SUPPLY TECHNOLOGIES

96

UK based, supply chain

management services,

provider of Class C

production components to

aerospace customers

Private individuals

US based, supply chain

management services

SELLER

BUYER

DEAL

VALUE

MULTIPLIER

01/06/2014

06/05/2014

08/04/2014

01/04/2014

ROLLS-ROYCE PLC

ROLLS-ROYCE PLC

SIEMENS AG

97

UK based, gas, turbine and

compressor business of

Rolls-Royce Plc

UK based provider of

integrated power solutions

for customers in civil and

defence energy markets

German based electronics

and electrical engineering

company

785

0.9x Revenue

10.9x EBITDA

1.6x Revenue

14

RMEC LIMITED

MAVEN CAPITAL

PARTNERS UK LLP

98

UK based supplier of

hydraulic engineering

equipment for oil&gas sector

UK based Private Equity firm

21.63

TELESTACK LIMITED

ASTEC INDUSTRIES INC.

99

UK based manufacturer of

mobile, telescopic and radial

stockpiling conveyors

US based manufacturer of

road building equipment

TARGET

DISTRIBUTION

OF DEAL

VALUES

(2105)

£0-5m

> £5-15m

> £15-30m

>£30-50m

>£50-150m

>£150-300

>£300

10% 10%

17%

8%

6%

17%

33%

ACQUIRES IN

DEAL RANGE

£ 50-300m

PE, VC, Funds,

Investment

Companies

Companies

operating in

the same/

similar sector

58%

42%

Identified sale/purchase of UK Precision Engineering companies, April 2014 to June 2015

46

Source: Cyrus Investment Management LLP

46