14

MARKET UPDATE

In 2015, the size of the UK Precision

Engineering market rose by 1.1%

year on year to £5.83 billion, with

the majority of the 1500

1

Precision

Engineering companies in the UK being

small to medium sized companies

with a turnover of £2 to £5 million,

a large portion of which service a

single client or sector such as the

automotive industry or the aerospace

industry. This is in keeping with the

wider engineering sector in which

most engineering enterprises (97.1%)

are either small or micro and, overall,

86.9% of engineering enterprises

have fewer than 10 employees.

2

Plimsoll’s Precision Engineers Market

Report 2015, shows that 400 companies

are making a loss (over a quarter of the

companies in the marketplace) and 161

companies have lost over a quarter of

their value in the last year. This reflects

the difficulties which can occur with

over reliance on one customer and

lack of diversification across sectors.

Market commentators also point

out that long established companies

can become institutionalised, lose

innovation and lack the cash flow

to renew machinery, particularly in

times of cutbacks in manufacturing.

Having said that, Plimsoll reports

examples of excellent profitability in the

industry and shows average company

sales growth at 4.4%, up 2% year on

year. It also finds that 40% of companies

achieved the 10% return on investment

that an investor would typically be

looking for, whilst the average is around

7.9% return on investment, with larger

companies generally outperforming

their smaller counterparts: The pre-

tax profit return on total assets of a

larger company is 9.2%, outperforming

their smaller counterparts who

manage 6.0%

1

. This suggests that

economies of scale can have an

important impact. For the most part,

the averages in this industry compare

favourably with the UK averages:

The Precision Engineering market did, however, follow the trend of the recent economic downturn, although it was, to some

extent, supported by smaller scale manufacturing output, the need for cost saving innovation and by maintenance and repair

work which is an on-going source of business. As a result, unsurprisingly, the figures show negative sales growth in 2009/2010.

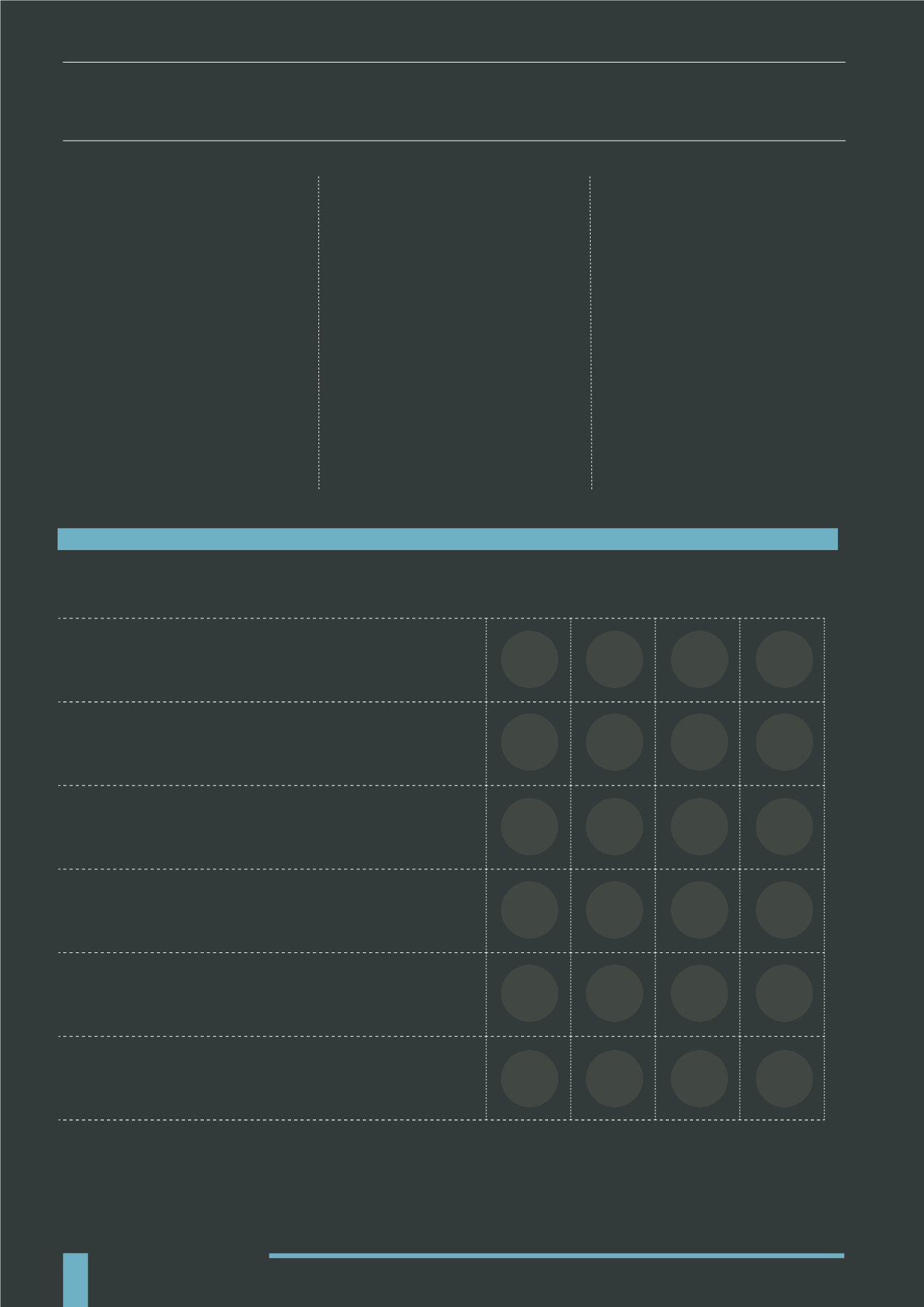

GROSS MARGIN (%)

TRADING PROFIT MARGIN (%)

PRETAX PROFIT MARGIN (%)

PRETAX PROFIT +

DIRECTORS FEES MARGIN (%)

PRETAX PROFIT RETURN ON

SHAREHOLDERS FUNDS (%)

PRETAX PROFIT RETURN ON

TOTAL ASSETS (%)

UK PRECISION ENGINEERING COMPANIES PERFOMANCE DATA

1

(2015)

30.4

35.5

28.6

20.8

5.9

15.2

10.8

5.6

3.6

11.8

5.7

1.9

5.6

14.3

8.7

3.4

12.8

28.5

15.7

4.5

5.4

13.9

7.9

2.2

UK

AVERAGE

UPPER

AVERAGE AVERAGE LOWER

AVERAGE