33

This is not a new concept as other

sectors evidence the practise of

investing in single companies and

integrating them into a consolidated

business for exit or IPO. One example

is the funeral industry which has

seen a number of takeovers of small,

family run businesses by larger funeral

providers such as Service Corporation

International and the Co-op.

68

“The new rules will make sure that EIS and VCT money is used for the growth and development

of investee companies”

David Gauke MP, Financial Secretary to the Treasury

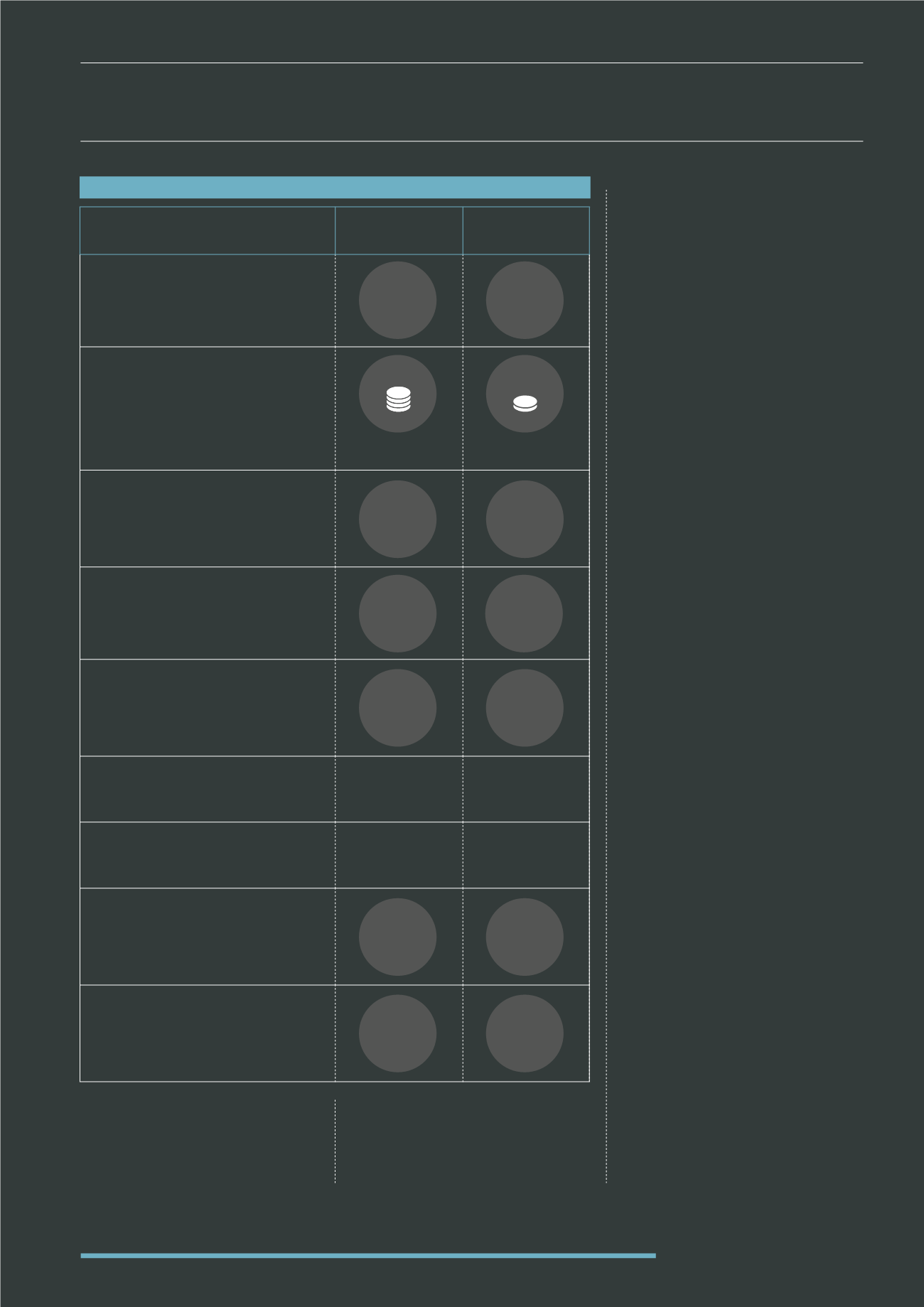

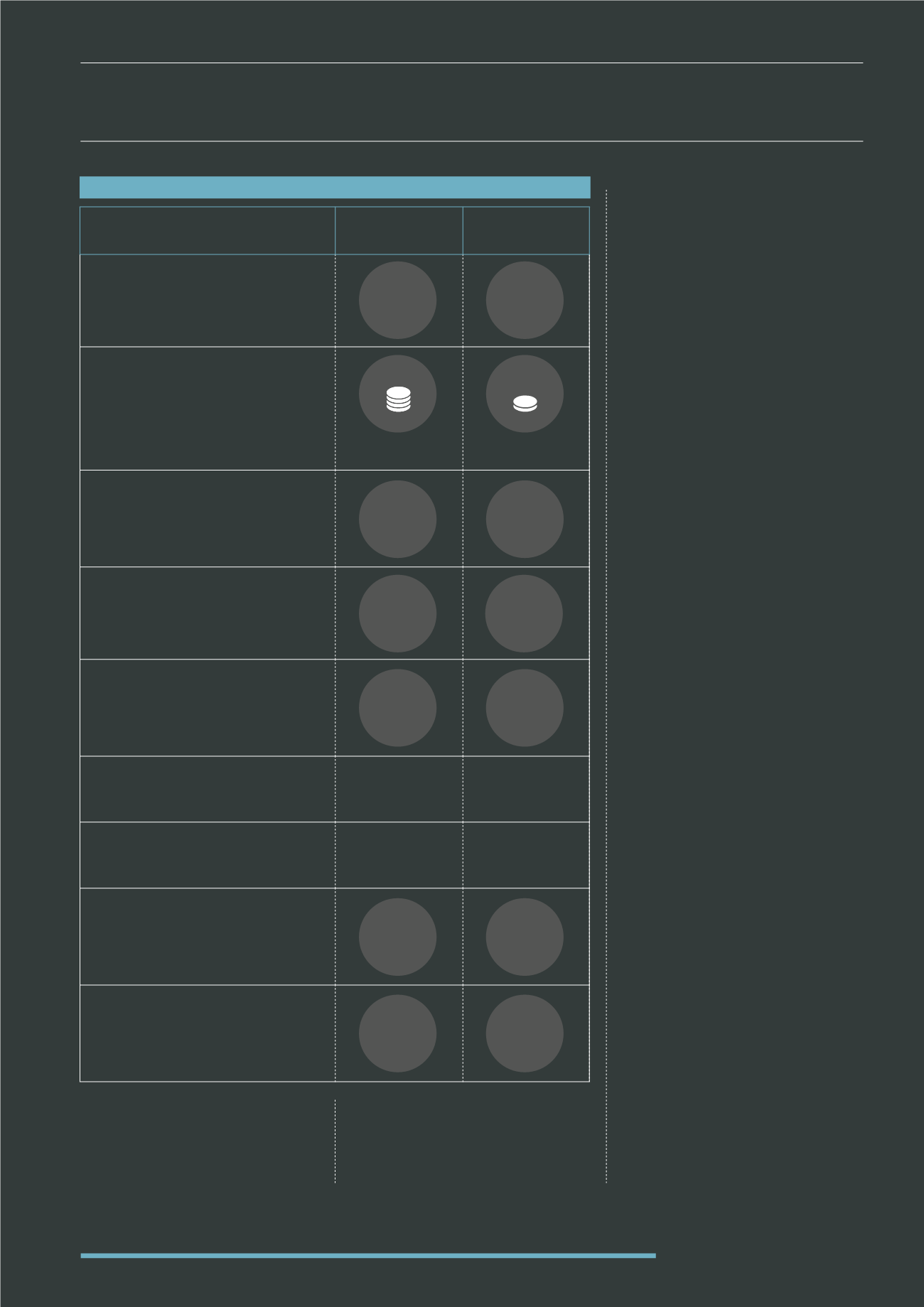

EIS

2015 / 2016

VCT

2015 / 2016

INCOME TAX

MAXIMUM ANNUAL

INVESTMENT

TAX RELIEF

HOLDING PERIOD

ONE YEAR CARRY BACK

DIVIDENDS

TAXABLE

EXEMPT

CAPITAL GAINS TAX

GAINS EXEMPT

AFTER 3 YEARS GAINS EXEMPT

CAPITAL GAINS TAX

DEFERRAL RELIEF

CAPITAL GAINS

TAX HOLIDAY

EIS/VCT TAX RELIEFS COMPARISON

64

Whilst other VCTs and EIS don’t focus

specifically on Precision Engineering

and therefore don’t take advantage of

the potential synergies between sector

companies, they do benefit from a

wider industry diversification across

other industries. Nevertheless, Cyrus

IM argues that this dilutes the full

potential of the Precision Engineering

market – which can still diversify across

sectors such as oil and gas, automotive,

aerospace etc…

The entry level for the first EIS fund

was £50,000, but this has dropped

for the second fund to allow entry

to more interested parties. The EIS

Fund fees are not insignificant, but

fairly typical of the EIS market, with a

2 % Transaction Fee on subscription

(this can be up to 5%)

69

, 1.75 % Annual

Management Charge, 0.65 % Dealing

Charge on purchases and sales of

shares in Investee companies, 0.1

% Quarterly Audit and Legal Fee

and a 30 % Performance Fee over a

hurdle of the minimum target return

of £1.27 per share per £1 invested.

This performance fee is higher

than is generally the case, but this

reflects the specialist nature of the

investments, ensures Cyrus’ and the

investors’ interests remain aligned

and results from the need for on-going

active involvement with the investee

companies to reach the targeted exit.

The company and its lawyers have

looked at the proposed new legislation

in the EIS/VCT sector, and their

understanding is that it requires EIS

investments to provide new working

capital for an investee business

along with a growth strategy which

may include new management,

products and markets. The Cyrus IM

interpretation of this new directive

is that it enshrines the principle of

growth investment which Cyrus IM

already adheres to in its present fund

(Cyrus 1) and both Cyrus Investment

Management LLP and its lawyers are

confident that the continuation of this

strategy in Cyrus 2 will comply with the

new rules.

£1,000,000 £200,000

3

YEARS

YES

YES

NO

NO

30% 30%

30% 30%

5

YEARS

NO

NO